The Apple Credit Card offers a seamless and rewarding experience for users. This article guides you through applying for an Apple Card online.

You’ll learn the key features, eligibility requirements, and application steps. Then, let’s explore how to obtain and use your Apple Card easily.

What is the Apple Credit Card?

The Apple Credit Card is a financial product that integrates seamlessly with your devices. It offers unique features and benefits tailored to enhance your financial experience.

Issuing Bank: Goldman Sachs

The Apple Credit Card is issued by Goldman Sachs, which provides the backing and infrastructure for the card and guarantees a trustworthy and robust credit card experience. This partnership ensures a reliable and secure financial service.

Key Features and Benefits

This card provides various advantages to its users. Key features include Daily Cash rewards and no fees.

Daily Cash Rewards

With Daily Cash rewards, you earn cash back on purchases. You get 2% back when paying with your iPhone or Apple Watch. These rewards are credited daily, allowing you to use them immediately. It’s a straightforward and valuable benefit.

No Fees

The card has no annual, late, or foreign transaction fees, making it a cost-effective option for users. You won’t be surprised by hidden charges; it’s a transparent and user-friendly policy.

Enhanced Privacy and Security

Core features include enhanced privacy and security. Advanced security measures protect your transactions, and Apple doesn’t track your spending habits, ensuring your personal information remains private.

Eligibility Requirements

There are specific criteria you must meet to apply for this card.

Age and Residency Requirements

You must be at least 18 years old and a U.S. resident. These are basic eligibility criteria. Ensure you meet these requirements before applying. It’s a standard for most credit cards.

Credit Score Considerations

A good credit score improves your chances of approval. While specific scores aren’t disclosed, higher scores are generally preferred.

Your credit history will be reviewed. This helps determine your creditworthiness.

Required Documents and Information

You’ll need to provide personal details such as your name and address and financial information like income.

Ensure all documents are ready before applying. This streamlines the application process.

How to Apply Online?

Applying online is a simple and quick process. Follow these steps to get started.

Steps to Apply Through the Wallet App on iPhone

You can apply using the Wallet app on your iPhone. Here are the steps to follow.

Open the Wallet App

First, open the Wallet app on your iPhone. This is where you manage your cards.

Tap the “+” Sign to Add a New Card

Next, tap the “+” sign at the top right to add a new card.

Select “Apple Card” and Follow the Prompts

Select “Apple Card” from the options. Follow the prompts to complete your application.

Information to Provide During the Application

You’ll need to provide specific information during the application. Ensure all details are accurate.

Personal Details

Please provide your full name and current address to verify your identity. You may also need to provide your phone number and email address. Accurate details ensure smooth processing.

Financial Information

Enter your annual income and employment status. This helps assess your creditworthiness. Be honest and precise with your financial information. It affects your approval chances.

Review and Accept Terms and Conditions

Read through the terms and conditions carefully. They outline your responsibilities and the card’s features.

Ensure you understand all clauses before accepting. Once you have reviewed the terms, accept them to proceed. This step is crucial for legal compliance.

Instant Approval Process and Card Activation

After submitting your application, you may receive instant approval. If approved, your card details appear in the Wallet app.

Follow the instructions to activate your card. You can start using it immediately for purchases. This swift process ensures you access benefits right away.

Interest Rates and Fees

Understanding the interest rates and fees is crucial. This section breaks down these details.

Explanation of Interest Rates (Variable APR)

The card has a variable APR. This means your interest rate can change.

Current APR Range

The current APR range for this card is 10.99% to 21.99%. Your exact rate depends on your creditworthiness. Higher credit scores generally get lower APRs.

These rates are accurate as of February 1, 2024. It’s important to note that APR can fluctuate based on market conditions. Always check the latest rates.

Details on Fees

There are no hidden fees with this card. Here’s a breakdown of the fee structure.

No Annual Fee

This card does not have an annual fee, which saves you money each year. You won’t be charged just for having the card.

This feature makes it more affordable. You can enjoy the card’s benefits without extra costs. It’s a straightforward policy.

No Late Fees

This card does not charge late fees, so you won’t be penalized if you miss a payment. This offers some financial flexibility.

However, it’s still important to pay on time to maintain good credit health. Late payments can affect your credit score.

No Foreign Transaction Fees

No foreign transaction fees exist so you can use your card abroad without extra charges.

This benefits frequent travelers, as you save money on every overseas purchase. It’s a great feature for international use, making the card travel-friendly.

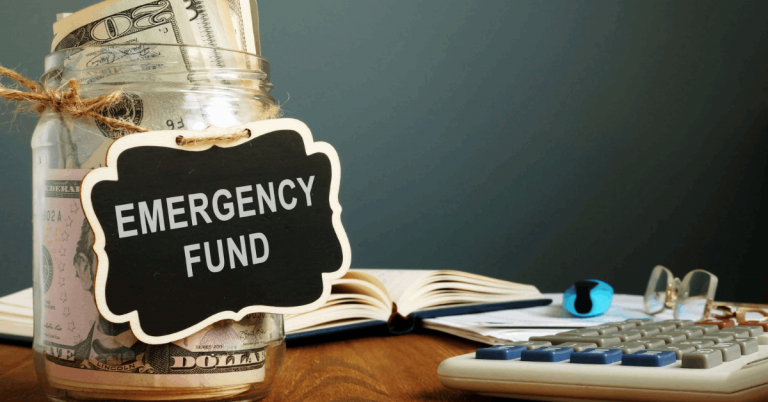

Managing Your Apple Card

Effectively managing your card ensures you get the most out of its benefits. Here are key points to keep in mind:

- Track your spending: Use the Wallet app to monitor your transactions.

- Set up automatic payments: Ensure timely payments and avoid interest charges.

- Redeem Daily Cash rewards: Check your rewards balance and use them as needed.

- Update personal information: Keep your contact and financial details current.

- Contact customer support: Reach out for assistance with any issues or questions.

Customer Support

If you need assistance, customer support is available. Here’s how to get in touch.

The bank’s Telephone Number and Hours of Operation

For support, call 877-255-5923. The customer service team is available to assist you during regular business hours. You can also visit the website for more information and assistance.

Address for Mailing Queries or Concerns

For any mailing queries or concerns, use the following address: Goldman Sachs Bank USA, Salt Lake City Branch. Ensure your correspondence includes all relevant details.

This helps the support team address your issues efficiently. Mailing queries may take longer to resolve. Always keep a copy of your correspondence for reference.

Disclaimer: Terms and conditions are subject to change. Always review the latest terms and conditions before applying.

Wrapping Up: Apple Credit Card – How to Apply Online?

In conclusion, applying for the Apple Card Online is straightforward and convenient. Follow the steps outlined in this guide to ensure a smooth application process.

Remember to review all details and terms before submitting your application. This card offers various benefits that can enhance your financial experience.

Read in another language

- Español: Tarjeta de crédito de Apple – Cómo solicitar en línea

- Bahasa Indonesia: Kartu Kredit Apple – Cara Mendaftar Secara Online

- Bahasa Melayu: Kad Kredit Apple – Cara memohon secara dalam talian

- Čeština: Apple kreditní karta – Jak podat online žádost

- Dansk: Apple-kreditkortet – Sådan ansøger du online

- Deutsch: Apple Kreditkarte – So bewerben Sie sich online

- Eesti: Apple krediitkaart – Kuidas taotleda veebis

- Français: Carte de crédit Apple – Comment faire une demande en ligne

- Hrvatski: Apple kreditna kartica – Kako se prijaviti online

- Italiano: Carta di credito Apple – Come fare domanda online

- Latviešu: Apple Kredītkarte – Kā pieteikties tiešsaistē

- Lietuvių: Obuolių kreditinė kortelė – Kaip pateikti internetinę paraišką

- Magyar: Apple hitelkártya – Hogyan lehet online jelentkezni

- Nederlands: Apple Credit Card – Hoe online aan te vragen

- Norsk: Apple Kredittkort – Hvordan søke online

- Polski: Aplikowanie o Kartę Kredytową Apple – Jak złożyć wniosek online

- Português: Cartão de Crédito Apple – Como solicitar online

- Română: Card de Credit Apple – Cum să aplici online

- Slovenčina: Apple Kreditná Karta – Ako sa prihlásiť online

- Suomi: Omena Luottokortti – Miten hakea verkossa

- Svenska: Apple-kreditkortet – Hur man ansöker online

- Tiếng Việt: Thẻ tín dụng Apple – Hướng dẫn đăng ký trực tuyến

- Türkçe: Apple Kredi Kartı – Nasıl çevrimiçi başvuru yapılır

- Ελληνικά: Κάρτα Apple Credit – Πώς να υποβάλετε αίτηση Online

- български: Карта за кредит на Apple – Как да кандидатстваме онлайн

- Русский: Кредитная карта от Apple – как подать заявку онлайн

- עברית: כרטיס אשראי של אפל – איך להגיש בקשה אונליין

- اردو: ایپل کریڈٹ کارڈ – آن لائن اپلائی کرنے کا طریقہ

- العربية: بطاقة آبل الائتمانية – كيفية التقديم عبر الإنترنت

- فارسی: کارت اعتباری اپل – چگونه آنلاین درخواست دهیم

- हिन्दी: एप्पल क्रेडिट कार्ड – ऑनलाइन आवेदन कैसे करें

- ภาษาไทย: บัตรเครดิตแอปเปิ้ล – วิธีการสมัครออนไลน์

- 日本語: アップルクレジットカード – オンラインでの申し込み方法

- 简体中文: 苹果信用卡 – 如何在线申请

- 繁體中文: 蘋果信用卡 – 如何線上申請

- 한국어: 애플 신용카드 온라인 신청 방법