Housing remains the largest purchase most people make, and the savings target can feel distant when prices rise faster than wages.

A clear plan to save for a down payment on a house trims guesswork, sets a realistic timeline, and protects the budget against surprises.

In the U.S., the median sales price was $419,300 in Q4 2024, with wide regional gaps that demand local research.

Do Your Housing Research

Local price dynamics matter more than national headlines. Compare actual closed-sale prices, not just listing medians, and note how features like school zones, commute times, and access to services shape value.

Regional medians illustrate the spread: in Q4 2024, the median new-home price was $782,300 in the Northeast, $560,200 in the West, $378,100 in the Midwest, and $376,400 in the South, versus $419,300 nationally.

That gap can double the savings target depending on location.

Set a Clear Savings Goal

Translating research into a number and deadline keeps progress tangible. Choose a target purchase window, then back into the monthly saving amount required to hit both the down payment and the closing costs estimate.

Calibrate for taxes, insurance, and reserves so the future payment fits your cash flow even if rates shift before closing.

What Size Down Payment Can You Make?

A 20% down payment removes private mortgage insurance on many conventional loans and may improve pricing, though it isn’t mandatory.

The CFPB notes PMI is typically not required at 20% down, and many borrowers remove PMI once equity thresholds are met by law or contract.

Some buyers use 3%–5% down conventional options or other programs to enter the market sooner, trading higher monthly costs for earlier equity building.

Where Are You Saving for Your Down Payment?

Short horizons favor safety and liquidity. Consider how rate changes affect returns and access.

| Vehicle | Typical Role | Access & Notes |

| High-yield savings account | Primary bucket for near-term funds | FDIC/NCUA-insured; top HYSAs around 4.2%–4.5% APY in Oct. 2025; rates variable. |

| Certificate of deposit (CD) | Fixed rate for a set term | Potentially slightly higher APY than savings; some no-penalty CDs allow early withdrawal; best rates near 4%–4.45% recently. |

| Taxable brokerage | Optional for longer horizons | Market risk; potential for higher returns and losses; consider tax on realized gains. |

Assess Your Current Financial Situation

Affordability rests on income stability, credit profile, debt loads, and liquidity. Inventory every source of income, list fixed and variable expenses, and total existing savings and investments.

Large cuts to big-ticket costs typically move the needle more than small everyday trims.

- Credit profile: Conventional underwriting generally expects a minimum 620 credit score, while program overlays can be higher. Strengthening credit can lower rate and mortgage insurance costs.

- Capacity: Under the General QM standard, the traditional cap has been a 43% debt-to-income ratio, though rules and price-based alternatives have evolved; lenders still target prudent DTI bands. Keep headroom for taxes, insurance, and maintenance.

- Documentation: Organize pay stubs, W-2/1099 or country equivalents, tax returns, bank and investment statements, and gift letters if family support will be used. Accurate paperwork speeds mortgage pre-approval and reduces last-minute underwriting surprises.

“Buying a home is emotional, but making decisions based on affordability—not excitement—is key,” said Thao Truong, CFP, CDFA, noting that a budget review clarifies how much time is required to reach the down payment target.

Heather Winston adds that a written plan covering down payment, fees, and timeline helps surface obstacles early.

Explore Eligibility for Low-Down Payment Mortgages

Lower-down options can be appropriate when savings time is long or prices are rising. Confirm eligibility, property limits, mortgage insurance rules, and long-term costs before committing.

FHA Loans

FHA allows 3.5% down with 580+ credit scores; scores 500–579 generally require 10% down. Upfront and annual mortgage insurance apply, so compare lifetime costs against conventional options as credit improves.

VA Loans

Eligible service members, veterans, and some surviving spouses may access 0% down, no PMI, and competitive pricing, subject to lender credit and income checks and VA entitlement.

USDA Loans

In designated rural areas, USDA programs can offer 100% financing to qualifying low- to moderate-income households. Property location and income caps apply.

Down Payment Assistance

Public and nonprofit down payment assistance programs offer grants, deferred loans, or forgivable seconds to reduce cash-to-close.

Start with HUD’s state directories and program overviews; availability, amounts, and repayment rules vary widely.

The HUD Good Neighbor Next Door program offers eligible teachers, law enforcement, firefighters, and EMTs a 50% discount on select homes, with a three-year occupancy requirement.

Develop a Savings Plan

Turning intention into automation is where momentum builds. Track progress monthly and adjust as income, rent, or rates change.

Automate Your Savings

Route a fixed amount each payday into a separate account labeled for the goal—an automatic savings plan reduces friction and avoids “leftover money” guessing.

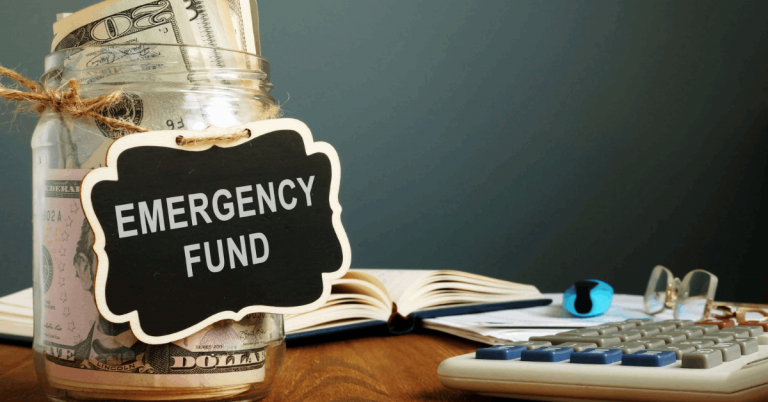

Use a Dedicated Account

Mixing spending cash and down payment funds causes leaks. A standalone high-yield savings account keeps principal safe and visible while earning interest that compounds toward closing.

Increase Income

Temporary overtime, seasonal shifts, freelance work, or selling unused items can accelerate savings. Evaluate tax implications and sustainability before committing to large time blocks.

Capture Windfalls

Earmark bonuses, tax refunds, or gifts directly to the goal. If family support is planned, align early on documentation so funds are acceptable under lender rules for sourcing and seasoning.

Trim Big Expenses First

Large categories, housing, transport, travel, dining, offer outsized gains. For example, moving to a lower-rent neighborhood for a year or postponing a car upgrade may free hundreds per month.

Consider Retirement-Plan Loans Cautiously

Workplace plan loans bring risks but can be available under strict rules.

The IRS caps loan amounts (generally the lesser of 50% of vested balance or $50,000), requires level payments at least quarterly, and sets a five-year maximum term except for loans used to buy a primary residence, where longer terms can be permitted by the plan.

Leaving an employer can trigger accelerated repayment or tax consequences if the loan becomes a deemed distribution. Treat this path as a last resort.

How Long Does It Take To Save a Down Payment?

Timelines hinge on home price, chosen down payment, assistance eligibility, and monthly surplus. While some buyers target 20% to avoid private mortgage insurance, NAR’s 2024 profile shows a 9% median down payment for first-time homebuyer purchases, reflecting the trade-off between speed and monthly cost.

Closing fees add roughly 2%–5% of the purchase price for many transactions, while FHFA characterizes typical costs as 3%–6% of the loan amount—use local quotes for precision.

As a simple example, a buyer needing $40,000 for down payment plus fees who saves $1,000 monthly reaches the target in 40 months. Doubling contributions by house-sharing or increasing income can cut the wait significantly, but ensure sufficient emergency reserves remain intact.

Monthly Payment Variables to Model

A realistic budget stress-tests the payment across interest rate bands and property tax scenarios. Principal and interest hinge on loan size and rate; taxes and insurance vary by location and home type.

Add mortgage insurance if applicable. A reputable calculator or lender worksheet helps compare offers and estimate amortization, but true numbers finalize only after underwriting and a signed purchase contract.

Conclusion

Disciplined preparation makes a complex purchase manageable. Start with local market data, then define a specific number and deadline, verify eligibility for affordable loan programs, and automate savings in accounts designed for safety and liquidity.

Keep contributions steady, feed windfalls to the goal, and revisit assumptions when income or rates change.

A focused plan to save for a down payment on a house turns a moving target into a timeline that fits present-day finances without overreaching.