Steady savings start with clear visibility and deliberate choices. Reducing Monthly Subscription Expenses doesn’t require deprivation; it requires structure, timing, and strong cancellation habits.

Expect quick wins from trimming unused services, negotiating terms, and setting spending ceilings that align to real usage.

Start With a Clear Picture of Spending

Accurate tracking turns guesses into data. Map monthly income and every recurring charge, including quarterly and annual renewals that slip past attention.

Banking dashboards and subscription management apps help surface patterns; manual logs in a spreadsheet work well when cash spending is common or multiple cards are involved. The U.S. Consumer Financial Protection Bureau recommends tracking spending for at least several weeks to reveal habits and leaks.

“Track every dollar you spend for a minimum of two months to see how accurate your estimates really are,” advises Brian Ford, Head of Financial Wellness at Truist. Consistent tracking often restores a sense of control and confidence.

Categorize Needs, Wants, and Values

Strong budgets separate essentials (housing, food, utilities) from nice-to-have subscriptions.

Price-check essentials periodically; grocery delivery, for example, may cost more than in-store alternatives after fees and tips. For non-essentials, weigh alignment to personal values and goals.

Funding a language class or family video plan may deliver more satisfaction than stacking redundant platforms. Values-based allocations reduce guilt and improve follow-through during cutbacks.

Identify Recurring Charges and Trim Fast

Short audits reveal hidden renewals and overlapping features. Search inboxes for receipts, scan card statements for “auto-renew,” and list next renewal dates.

Then apply a simple subscription audit checklist to decide keep, pause, or cancel.

- Gym membership: Pause during busy months and use at-home or outdoor workouts.

- Commuting costs: Carpool to reduce fuel, parking, and wear.

- Food delivery subscription: Prefer pickup or cook-at-home weeks to reset costs.

- Streaming services: Run a rotation and keep only one active at a time.

- Cloud or storage tiers: Downshift plans after deleting duplicates and old media.

Reduce Impulse Buys That Trigger New Subs

Social feeds and email promos push time-limited offers that become recurring drains.

Bankrate data show nearly half of social media users made an impulse purchase and about two-thirds regretted at least one of those buys, reinforcing the value of cooling-off tactics.

Set filters for promo emails, remove saved cards on shopping sites, and use free trial reminders to prevent unplanned rollovers.

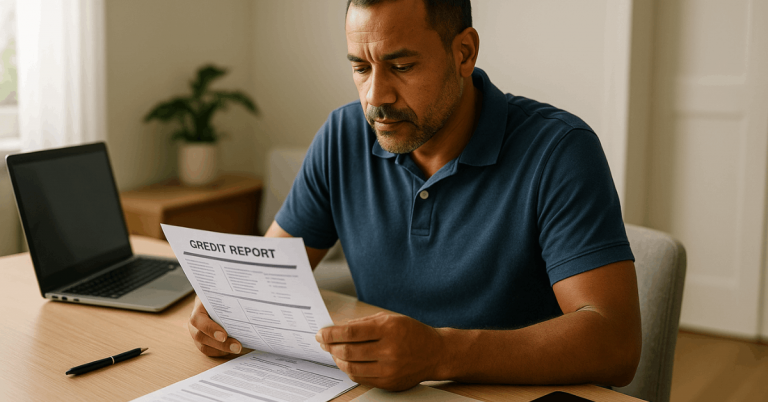

Lower the Cost of Debt Tied to Subscriptions

Interest erodes monthly flexibility when balances accumulate. A prudent balance transfer strategy can temporarily reduce card interest; expect a transfer fee even on 0% introductory offers and note that intro APRs must last at least six months unless payments are over 60 days late.

Always plan payoff timing ahead of the intro expiration. Refinancing can also help when loans carry high rates.

Consider opportunities to refinance high-interest debt, but run full cost scenarios first, including origination, appraisal, and closing fees. If refinancing isn’t economical, schedule small extra principal payments to shorten amortization and cut total interest over time.

Make Subscriptions Work Harder

Short, focused sprints keep recurring costs lean while preserving the services that matter. The steps below operationalize cuts and prevent re-growth.

Think in sprints:

- inventory,

- assess value,

- act, and

- review.

Add calendar reminders so trials and renewals never surprise the budget. Use platform rights to cancel subscriptions online when interest fades, and leverage region-specific consumer protections to avoid dark-pattern traps.

U.S., U.K., and EU rules increasingly require simpler cancellation flows and clearer consent disclosures, though enforcement and litigation status vary.

Build an Inventory

List every subscription, billing cycle, price, renewal date, and last meaningful use. Mark services as Essential, Seasonal, or On-Trial. Capture overlapping features such as cloud storage bundled in other plans.

Assess Actual Value

Score each service on cost-per-use, unique benefits, and alignment to goals. Flag platforms not used in the last 30–60 days for pause or cancellation.

Cancel or Pause Strategically

Use on-site flows to cancel subscriptions online; in many jurisdictions, companies must provide straightforward mechanisms.

In the U.S., the FTC’s amended Negative Option Rule targeted “click-to-cancel,” though a mid-2025 court ruling paused implementation; business guidance still stresses simple, same-medium cancellation.

The U.K. and EU have advanced measures against “subscription traps,” emphasizing easy exits and clear auto-renewal notices.

Explore Lower-Cost Alternatives

Switch to ad-supported tiers, free community tools, or annual plans only when the break-even point clearly favors the term. Rotate platforms monthly to follow new releases while keeping spending flat.

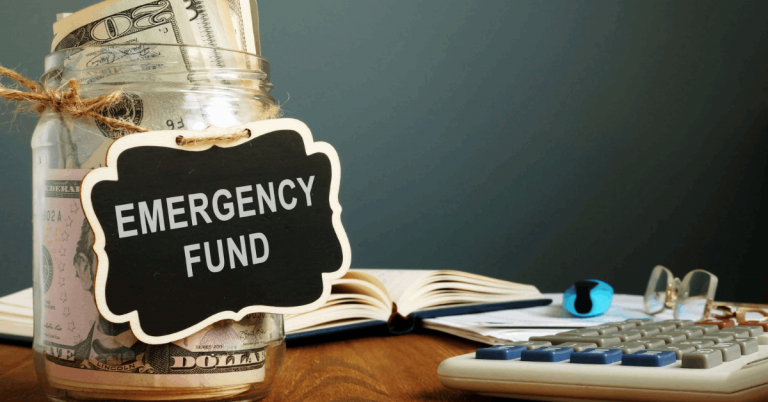

Set a Ceiling

Establish budgeting for subscriptions as a hard monthly cap. Treat the cap like rent: when adding one service, pause or cancel another. Maintain a small “trial slot” for testing new platforms without growing total cost.

Review on a Cadence

Schedule a recurring 30-minute calendar appointment every quarter to repeat the sprint: inventory, assess, act. Couple this with a quick net-worth check to confirm progress.

Share Costs Where Terms Allow

Activate family plan sharing on eligible platforms. Split costs transparently, clarify rules, and designate one owner to avoid missed payments or lockouts.

Ask for Retention Offers

Contact support via chat and request current promos, loyalty discounts, or temporary downgrades. Many providers release offers when customers indicate intent to cancel.

Guard Against Trial Traps and Dark Patterns

Clarity around consent and cancellation protects the budget. U.S. regulators finalized rules in 2024 requiring straightforward cancellation and clear negative-option disclosures; litigation in 2025 has delayed implementation timelines, but the principles remain a safe consumer baseline.

The U.K. government reported consumers losing roughly £1.6 billion annually to subscription traps and is tightening requirements around reminders and exits. The EU’s consumer law framework also emphasizes easy online cancellation and a 14-day cooling-off period for many digital contracts.

Practical safeguards help globally:

- set free trial reminders,

- disable auto-renew immediately after sign-up when the platform allows, and

- capture confirmation numbers or emails after cancellation.

Keep screenshots of cancellation pages until a zero-balance invoice appears.

Simple One-Page Action Plan

Immediate structure creates momentum and keeps decisions objective. Expect the steps below to reduce costs within one billing cycle without losing priority services.

Keep totals inside a fixed cap and cycle options in and out as interests change.

- Export card statements, tag all recurring charges, and complete a subscription audit checklist.

- Classify every item as Essential, Seasonal, or On-Trial; cancel or pause the bottom third.

- Set a monthly cap labeled budgeting for subscriptions and add a standing quarterly review.

- Move one platform to an ad-supported tier and enable family plan sharing where terms allow.

- Create calendar free trial reminders and store cancellation confirmations in a single folder.

When Debt Tools Make Sense

Short-term interest relief works only with a payoff plan. A disciplined balance transfer strategy reduces interest while the principal falls; avoid new spending on the transfer card, and set automatic payments to clear the balance before the promotional window ends.

Refinancing may help mortgages, autos, or personal loans, provided total savings exceed fees and break-even occurs within the holding period.

Regulators emphasize reading APR terms, fee schedules, and change-in-terms notices; the CFPB’s consumer tools offer clear explanations of APRs, transfer fees, and introductory rate rules.

Conclusion

Subscription costs shrink fastest when tracking is precise, cancellations are simple, and spending caps are enforced.

Expect durable savings from quarterly reviews, platform rotation, negotiated offers, and shared plans.

Keep debt inexpensive while balances fall, and protect against trial traps through reminders and documented cancellations. The goal is a lean, values-aligned mix that delivers real use, without monthly creep.