Prepaid cards are becoming one of the most practical tools for safe and easy online payments. When you use prepaid cards for online shopping, you avoid risks tied to credit cards or bank accounts.

These cards help you control spending while giving access to global e-commerce platforms. In this guide, you’ll learn everything about using them smartly and securely.

Understanding Prepaid Cards

Before you start shopping, it’s important to understand how prepaid cards work. They are preloaded with a fixed balance and can be used just like debit or credit cards online.

You can’t spend more than what’s loaded, making it an ideal tool for budgeting. There’s no link to your main bank account, which helps reduce exposure to fraud.

Types of Prepaid Cards

There are several prepaid card options that match different user preferences. Below is a quick overview of each type and how they can help you shop smarter online.

- Reloadable Prepaid Cards: These allow you to add funds multiple times, making them ideal for regular users.

- Gift Cards: Designed for single-use purchases, they’re great for gifting or small transactions.

- Virtual Prepaid Cards: Entirely digital, they are used for secure one-time online payments. Each type offers its own advantages depending on how frequently you make purchases online.

How Prepaid Cards Differ from Other Cards?

Prepaid cards are not credit cards and don’t require approval or a credit check. They differ from debit cards because they are not linked to a bank account.

Their spending limit is restricted to the amount you load. This control makes them appealing for users who want to manage money tightly.

Why Use Prepaid Cards for Online Shopping?

Using prepaid cards online brings security and convenience. You can shop anywhere Visa, Mastercard, or Amex are accepted without exposing bank details.

They’re especially useful for people who don’t qualify for credit cards. You’ll also gain a simple way to stick to your budget.

- Budget Control: You can only spend what’s on the card, preventing overspending.

- Security: There’s no direct connection to your savings or checking account.

- Accessibility: Anyone can use them, even without a traditional bank.

- Global Use: Accepted across major international e-commerce sites.

Getting and Setting Up Your Prepaid Card

It’s easy to obtain a prepaid card through retailers, banks, or online platforms. Choose one from reputable providers such as Visa, Mastercard, or American Express.

Make sure to register the card for online use. Once activated, check your balance to avoid transaction issues.

Loading and Managing Funds

You can load funds using cash deposits, transfers, or direct deposits. Some cards allow reloading through apps for easier control.

Tracking your spending through the issuer’s portal is recommended. Regular balance checks prevent declined purchases and missed opportunities.

Making Safe Online Purchases

Before buying online, always verify that the website is secure. Look for “https” in the web address and avoid entering card details on unknown platforms.

Always review your order summary before confirming payment. Safe practices reduce fraud and unauthorized transactions.

Using Virtual Prepaid Cards

Virtual prepaid cards provide extra protection for your online shopping. They generate a temporary card number for each transaction.

This limits the chance of your card data being stolen. Many users prefer virtual cards for subscription payments or one-time purchases.

Managing Your Spending Effectively

You can use prepaid cards as a financial management tool. Tracking your purchases helps you stay aware of your spending habits.

Many people use multiple cards for different categories, such as groceries or entertainment. This separation makes it easier to follow a personal budget plan.

Setting Spending Goals

Establishing a limit for monthly expenses keeps you disciplined. Review your transaction history weekly to see where your money goes.

Adjust your budget if you notice patterns of unnecessary spending. Over time, prepaid cards help improve your money management skills.

Security and Fraud Prevention Tips

Online shopping with prepaid cards is generally secure, but caution is key. Only buy cards from official stores or bank partners.

Registering the card ensures refund eligibility and balance recovery if lost. Regular monitoring of transactions helps catch suspicious activity early.

- Never share your card number or PIN with anyone.

- Be cautious of fake giveaway sites or phishing emails.

- Report lost or stolen cards immediately to the issuer.

- Keep digital receipts to track all purchases.

Comparing Prepaid Cards with Other Payment Options

Let’s look at how prepaid cards stand against other popular payment methods. They provide flexibility similar to credit or debit cards but without the same obligations.

This makes them ideal for people avoiding debt. However, each payment option serves different purposes depending on your needs.

Prepaid vs. Credit Cards

Prepaid cards don’t affect your credit score, while credit cards can build or hurt it. They’re safer for budgeting since there’s no borrowing involved.

However, prepaid cards don’t offer cashback or rewards like credit cards. The trade-off is security and spending control.

Prepaid vs. Debit Cards

Debit cards access your bank balance directly, unlike prepaid cards. If your debit card data is stolen, your bank account could be compromised.

Prepaid cards limit exposure since only the loaded balance is at risk. This makes them preferable for shopping on international websites.

Common Mistakes to Avoid

It’s easy to misuse prepaid cards without realizing it. Many people forget to register their cards or check expiration dates.

Others use them on unreliable websites that may not protect their data. Awareness of these mistakes helps you use prepaid cards more effectively.

- Unregistered Cards: Always register to enable refunds and support.

- Expired Balances: Check card validity regularly to avoid losing funds.

- Ignoring Fees: Review all service charges before buying or reloading.

- Unsafe Sites: Shop only on verified e-commerce platforms.

Recommended Prepaid Cards for Online Shopping

Here are several reputable prepaid cards worth exploring for online shopping. Each link leads to the official issuer’s site for more details and registration.

- Visa Prepaid Card: Available at Visa’s official website, this card is widely accepted worldwide and offers balance protection with simple reload options.

- Mastercard Prepaid Card: Learn more on Mastercard’s site; it’s reliable for local and international purchases and includes strong fraud protection.

- American Express Serve Card: Visit serve.com to explore this reloadable card that offers cashback benefits and mobile app tracking.

- NetSpend Prepaid Card: The NetSpend platform makes setup easy, supports direct deposits, and includes an intuitive account manager.

- Revolut Prepaid Card: You can check details on revolut.com; it supports multi-currency use and provides instant notifications.

- PayPal Prepaid Mastercard: Found at PayPal’s prepaid page, this card is convenient for linking with PayPal for smooth, quick checkouts.

What to Look for When Choosing?

Focus on cards that support international transactions. Look for reloadable options if you shop often.

Prefer issuers with mobile apps to manage spending efficiently. Check for transparent fees and fraud protection policies.

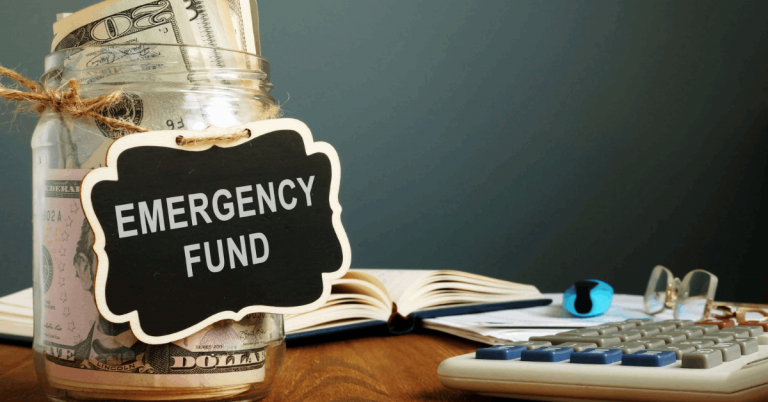

Smart Tips for Maximizing Your Prepaid Card

To get the best from your prepaid card, plan your spending carefully. Use notifications or balance alerts to track activity.

Avoid leaving large unused balances for long periods. Treat the card as part of your financial system, not just a shopping tool.

- Review spending monthly to understand your usage.

- Use prepaid cards for subscriptions and recurring payments.

- Reload safely through authorized sources.

- Always double-check your available balance before shopping.

Final Thoughts: Make Prepaid Cards Work for You

Using prepaid cards for online shopping is a smart way to stay safe, control spending, and enjoy global convenience. They give you freedom without the risk of debt or fraud exposure. By managing them wisely, you can simplify your online transactions and protect your finances. Whether you shop often or occasionally, prepaid cards can fit seamlessly into your financial routine.