Starting your investment journey doesn’t require a large sum of money. In fact, safe ways to invest small amounts can help you build wealth gradually while reducing risks.

By understanding low-risk options, you can grow your money without putting it in danger. This guide will show how to start small, stay consistent, and make every dollar work efficiently for your financial future.

Understanding the Concept of Safe Investments

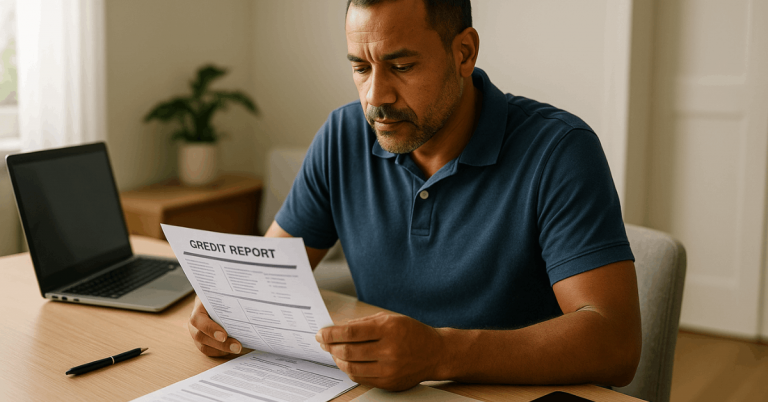

Before investing, you need to understand what makes an investment safe. Secure investments usually carry low risk but steady returns over time.

They protect your principal while allowing moderate growth. These are ideal if you’re new to investing or want to avoid market volatility.

Defining Safety in Investments

Safety in investments means prioritizing capital preservation. You aim to protect your initial money while earning smaller, consistent profits.

Options like savings accounts, government bonds, or certificates of deposit (CDs) provide this balance. They won’t make you rich overnight but ensure steady, reliable progress.

Balancing Risk and Return

All investments involve some level of risk, but the goal is to manage it wisely. The lower the risk, the lower the return—but that trade-off guarantees peace of mind.

By mixing low-risk assets and small investments, you can safely grow your funds. Smart investors diversify instead of betting everything on one source.

Preparing Before You Invest

You can’t start investing safely without preparation. Knowing your financial position and risk tolerance will guide your choices. Preparation minimizes mistakes and helps you set realistic expectations.

Set Clear Financial Goals

Write down what you’re saving for—retirement, education, or emergency funds. Specific goals keep you disciplined and focused.

When you know your purpose, choosing the right investment becomes easier. Clear direction also helps you monitor progress effectively.

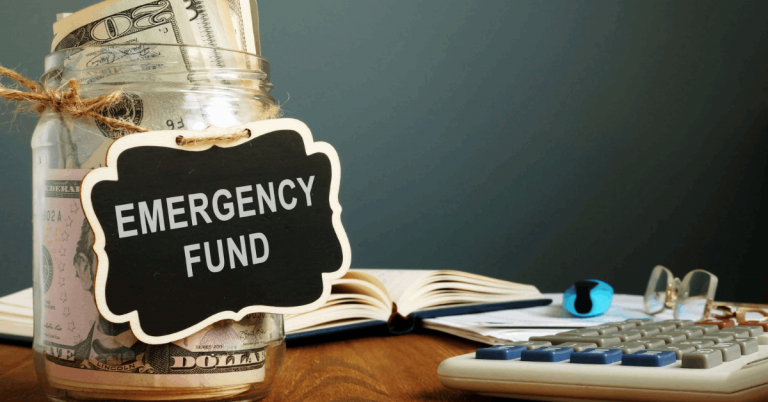

Build a Safety Net

Before investing, ensure you have an emergency fund. This prevents you from withdrawing investments too soon when unexpected costs appear.

Ideally, save at least three to six months’ expenses. Once you’ve done that, you can safely move small amounts into low-risk investments.

Safe Investment Options for Small Amounts

You don’t need to invest thousands to start earning. Several secure platforms and accounts allow you to begin with just a few dollars. Let’s explore the most reliable options for beginners.

High-Interest Savings Accounts

A high-interest savings account offers stability and quick access to funds. It’s insured and safe from market fluctuations.

While returns are modest, they outperform traditional savings. This is the simplest option for those starting out.

Certificates of Deposit – CDs

CDs or time deposits lock your funds for a set period. In exchange, you earn a fixed interest rate.

They are ideal for conservative investors who don’t need immediate access to their money. The longer the term, the higher the rate usually is.

Government Bonds and Treasury Securities

Government-backed investments are among the safest choices. They guarantee returns and are suitable for long-term savings.

You can start small by buying bonds through trusted online platforms. This is perfect for those who value reliability over high profits.

Robo-Advisors

Robo-advisors automatically invest your money based on your goals and risk tolerance. Many have no minimum deposit requirement.

They offer professional portfolio management at a fraction of traditional costs. Beginners benefit from automation and diversification in one tool.

Practical Strategies to Grow Small Investments

Investing small amounts is effective when you apply smart, consistent strategies. The key is discipline rather than the amount itself. Here are proven ways to make gradual yet meaningful progress.

Use Micro-Investing Apps

Micro-investing apps let you invest spare change from daily purchases. Over time, these small contributions add up.

They remove the pressure of large deposits and encourage consistency. Apps like Acorns or Stash make this process automatic and effortless.

Apply Dollar-Cost Averaging

Dollar-cost averaging means investing a fixed amount regularly. This method protects you from market timing errors.

When prices drop, you buy more; when prices rise, you buy less. It’s a simple way to smooth out risk and build long-term stability.

Reinvest Your Dividends

Instead of withdrawing profits, reinvest them. Reinvesting boosts compound growth and builds momentum.

This helps you achieve financial goals faster without additional capital. Patience and reinvestment are your best allies in wealth building.

Avoiding Common Mistakes in Small Investments

Many first-time investors lose money by skipping basic precautions. Knowing what to avoid saves time and frustration. Let’s focus on simple yet powerful ways to stay safe.

- Avoid chasing trends. Don’t invest based on hype or emotions; trends fade quickly.

- Check for hidden fees. High fees can reduce small profits and slow your progress.

- Don’t risk essential funds. Invest only what you can afford to lose.

- Research before committing. Always check the platform’s credibility and safety record.

Reliable Tools and Resources

Access to good tools helps you make smarter investment choices. Beginners can use digital platforms and educational websites to stay informed. Using trustworthy resources builds confidence and knowledge.

- Online banking platforms: offer easy access to savings, CDs, and bonds.

- Robo-advisor services: provide automated guidance for balanced portfolios.

- Educational sites: government financial education pages and verified blogs explain concepts clearly.

- Investment calculators: help visualize returns and plan contributions effectively.

Platforms That Help You Invest Small Amounts Safely

There are many trusted platforms that allow you to start small and invest securely. These tools are designed for beginners and make it easier to manage low-risk investments.

- Acorns – invests spare change automatically into diversified portfolios. Visit acorns.com for more details.

- Stash – allows small, regular investments in ETFs and fractional shares. More info available at stash.com.

- Robinhood – offers commission-free trading for stocks and ETFs with no minimum balance. Learn more at robinhood.com.

- Fidelity Spire – helps users set and track investment goals. Official details can be found at fidelity.com/spire.

- Betterment – a robo-advisor offering automated, low-risk investment management. Visit betterment.com to explore their plans.

- Wealthfront – ideal for hands-off investors seeking safe and diversified growth. More details can be viewed at wealthfront.com.

- Vanguard – known for low-cost mutual funds suitable for gradual, long-term investing. See vanguard.com for official information.

When to Seek Financial Guidance?

You don’t always need an expert, but professional advice can prevent costly mistakes. If you’re unsure where to start or overwhelmed by options, seek help.

Certified advisors can tailor plans to your goals and budget. Look for transparent professionals who charge flat fees instead of commissions.

They will help you create a clear investment path and ensure safety. Remember, good advice early on saves you from major errors later.

Maintaining a Long-Term Mindset

Safe investing isn’t about quick profit; it’s about steady progress. Small investments work best when you’re patient and consistent.

Over time, your discipline and regular contributions will lead to visible results. Even small returns compound significantly with time.

The secret is to stay invested, avoid panic, and let growth happen gradually. Focus on your long-term goals rather than daily market changes.

Keep Building Your Financial Confidence

Investing small amounts safely requires awareness, patience, and discipline. It helps you build strong financial habits while protecting your savings.

Consistency and research guide your progress toward steady growth. Start with what you can today and grow your confidence as your money works for you.