The purpose of this article is to guide you through the process of applying for an Amazon Rewards Visa Signature Card. You’ll learn about the card’s benefits, eligibility requirements, and application steps.

This information will help you make an informed decision. Let’s get started on making the most of this rewarding opportunity.

Overview of the Amazon Rewards Visa Signature Card

Chase Bank offers the Amazon Rewards Visa Signature Card. This card provides a range of rewards and benefits, making it a popular choice for frequent Amazon shoppers.

The card originated from a partnership between Amazon and Chase and aims to enhance the shopping experience. Users earn points on purchases and enjoy additional perks.

It’s designed for those looking to maximize their spending power. Understanding this card can help you make the most of its features.

Understanding the Amazon Rewards Visa Signature Card

This card offers various features that appeal to different types of spenders. You’ll benefit from a robust rewards structure and additional perks.

Rewards Structure

The reward structure is straightforward and rewarding. You earn points for purchases, which can be redeemed for various benefits.

Points for Amazon Purchases

You earn 3 points for every dollar spent on Amazon purchases. These points can be redeemed for discounts and other rewards.

This benefit is ideal for frequent Amazon shoppers, as it maximizes your savings on every purchase.

Points for Other Purchases

For purchases made outside of Amazon, you earn 2 points per dollar at gas stations, restaurants, and drugstores.

Other purchases earn 1 point per dollar. This ensures you earn rewards on a variety of spending. It’s a versatile feature for everyday use.

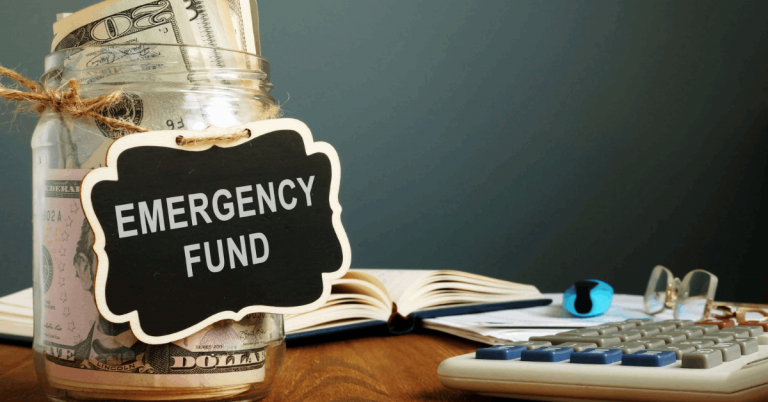

Additional Benefits

This card offers benefits beyond reward points. These features enhance your overall experience and savings.

No Annual Fee

This card does not charge an annual fee, making it a cost-effective choice for users. You can enjoy all the card’s benefits without an annual charge, which is an attractive feature for budget-conscious consumers.

No Foreign Transaction Fees

When using this card abroad, you won’t incur foreign transaction fees, which significantly saves travelers.

It allows you to make purchases internationally without extra costs. It’s ideal for frequent travelers.

Travel and Purchase Protections

The card offers travel and purchase protections. This includes travel insurance and extended warranties on purchases.

These protections provide peace of mind when traveling or making significant purchases. They add extra value to the card.

Interest Rates and Fees

Understanding the interest rates and fees is crucial. This section explains what you can expect.

APR for Purchases

The card offers a 0% promo APR for 6 or 12 months on purchases of $50 or more. After the promo period, a variable APR of 19.49% to 27.49% applies.

This can help manage large purchases initially, but it’s important to know the rates afterward.

APR for Balance Transfers and Cash Advances

Balance transfers and cash advances typically have higher APRs. Check the specific rates. Be cautious with these transactions, as they can incur additional costs.

Penalty APR

A penalty APR applies if you miss payments. This rate can be significantly higher than the regular APR. It’s essential to make payments on time. Avoiding penalties saves money.

Other Fees

There are other fees like late payment and returned payment fees. These can add up if not managed properly.

It’s crucial to be aware of these potential charges. Keeping track helps avoid unnecessary costs.

Eligibility Requirements

You must meet certain eligibility criteria to apply for the Amazon Rewards Visa Signature Card. This section outlines the essential requirements.

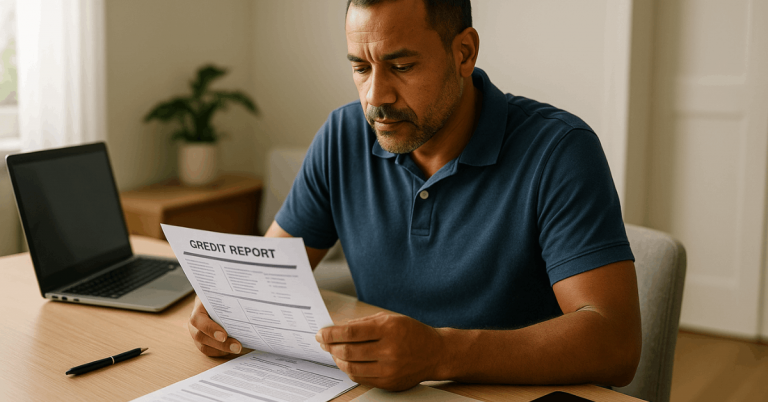

Credit Score Requirements

To qualify for this card, you generally need a good to excellent credit score, typically 700 or above.

Lenders use your credit score to assess your creditworthiness. Maintaining a high score improves your chances of approval.

Income Requirements

Applicants must also meet specific income requirements. You need a steady income to demonstrate your ability to repay.

This can include salary, investments, or other sources. Providing proof of income is essential during the application.

Other Eligibility Criteria

Other criteria include being 18 years old and have a valid Social Security number. U.S. residency is typically required.

You should also have a stable financial history. Meeting these criteria helps ensure a smooth application process.

Application Process

Applying for the Amazon Rewards Visa Signature Card involves several steps. This section will guide you through the process.

Preparing to Apply

Before applying, ensure you have all the necessary information. Checking your credit score is also a crucial step.

Gather Necessary Information

Collect your personal information, including your Social Security number and income details. Have your employment history ready as well. This information helps complete the application accurately, and being prepared can speed up the process.

Checking Credit Score

Check your credit score before applying. Knowing your current score helps set realistic expectations. Use a reputable credit check service. This ensures you meet the card’s credit requirements.

Step-By-Step Application Guide

Follow these steps for a smooth application process. You can apply online or over the phone.

Online Application Process

To apply online, follow these steps:

- Visit the official Amazon credit card website or Chase Bank website.

- Fill in the required personal and financial information.

- Review the terms and conditions.

- Submit your application.

Phone Application Process

To apply over the phone, follow these steps:

- Call the customer service number provided by Chase.

- Provide the necessary personal and financial details.

- Ask any questions you have about the card.

- Complete the application process with the representative.

What to Expect After Applying?

Understand the steps that follow your application. This includes the approval timeline and card activation.

Approval Timeline

After applying, you typically receive a decision within 7-10 business days. Some applicants may get instant approval. If more information is needed, it might take longer. Be patient and check your application status online.

Receiving and Activating the Card

Once approved, you’ll receive your card in the mail within 7-10 business days. Follow the instructions to activate your card, which can be done online or over the phone. After activation, you can start using your card.

Customer Support

Chase Bank’s customer service is available to help during the application process and with any questions or issues.

Chase Bank’s Customer Service and Address

For assistance, call Chase Bank’s customer service number at 1-888-280-4331. You can also visit or mail them at their address: 410 Terry Ave. North, Seattle, WA, 98109-5210.

Their support team is ready to help with your card application. Keep this information handy for any inquiries.

Disclaimer: Please review the card’s terms and conditions before applying. These details are crucial for understanding your responsibilities and benefits.

Final Words on Applying for an Amazon Rewards Visa Signature Card

Understanding how to apply for the Amazon Rewards Visa Signature Card is straightforward. By following the outlined steps, you ensure a smooth application process.

Remember to prepare all necessary information and check your credit score beforehand. For any assistance, Chase Bank’s customer support is readily available. This guide provides all the essential details to help you get started.