Pay Off Debt Fast strategies work when actions stay consistent and numbers stay visible.

Start by mapping every balance, restructure cash flow with a realistic budget, then pick a repayment method that fits your behavior and timeline.

Sustained progress comes from automation, timely minimums on every account, and aggressive extra payments directed at a single target balance.

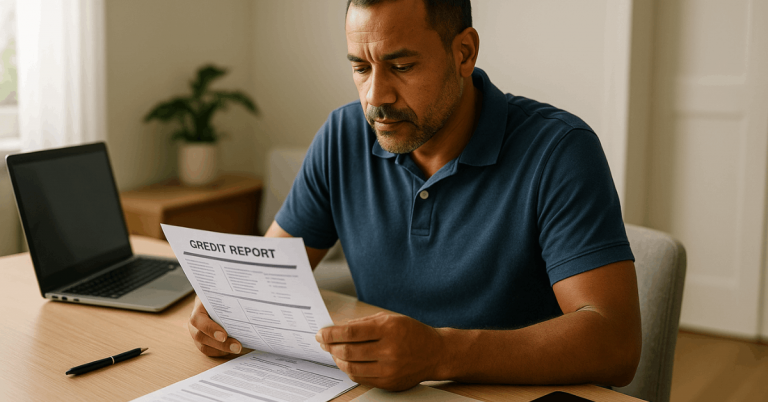

Get A Complete Picture Of What You Owe

List every obligation, credit cards, personal loans, auto loans, medical bills, and any buy now, pay later plans. Capture current balance, APR, minimum payment, and due date for each account.

Pull your credit report to verify open and closed accounts, spot any errors, and ensure no forgotten balances linger. Setting this baseline turns vague stress into a concrete plan.

Build A Realistic Budget That Protects Essentials

Track a full month of spending to separate essentials from wants. Consider frameworks like a zero-based budget, where every dollar gets assigned to a job, needs, savings, or debt, so leftovers don’t quietly disappear into impulse purchases.

Trim recurring costs that no longer deliver value, then redirect the savings to principal reduction. Resilience improves when fixed obligations remain affordable even during lean months.

Choose A Repayment Strategy That You’ll Actually Follow

A method that matches behavior outperforms a perfect plan ignored under pressure. Two proven approaches dominate expert guidance: target either the highest-rate debt or the smallest balance first.

The Consumer Financial Protection Bureau outlines both strategies and stresses picking the one that keeps payments moving.

How The Main Methods Compare

This table summarizes the most-used tactics for aggressive repayment. Pick one path, commit automation to it, and revisit quarterly. Switching methods repeatedly slows momentum and adds decision fatigue.

| Method | Best for | Upsides | Trade-offs | Key move |

| debt avalanche method | Reducing total interest cost | Mathematically fastest and cheapest | Early wins may feel slow on large first target | Pay minimums everywhere, send every extra dollar to the highest APR first. |

| debt snowball method | Motivation through quick wins | Rapid account closures build confidence | May pay more interest overall | Attack the smallest balance first while maintaining all minimums. |

| Hybrid focus | Balancing math and motivation | Flexible and adaptable | Requires periodic review | Start with one or two small wins, then switch to avalanche for interest savings. |

| Credit utilization targeting | Improving score while paying down | Lower credit utilization ratio can help credit health | Not always the costliest debt | Prioritize cards near their limits to lower utilization quickly. |

| Debt management plan | High unsecured debt with stable income | One payment, possible fee and rate concessions | Requires nonprofit counseling and creditor participation | Work through an accredited credit counselor to set a structured plan. |

Automate Payments And Safeguard Cash Flow

Set automatic payments for at least the minimum on every account to protect payment history and avoid late fees.

Schedule an automatic transfer of your extra debt payment right after payday so cash doesn’t drift to low-value spending.

If variable income complicates scheduling, use a small buffer fund to absorb timing gaps and keep debt automation uninterrupted. Reliability beats intensity when balances stay high.

Use Tools That Can Cut Interest And Simplify Payments

Consolidation and promotional offers can help, provided terms are understood and spending stays controlled. A balance transfer credit card moves an existing balance to another card, often with a promotional APR and a fee that’s typically a percentage of the amount transferred. Promotional rates last a limited time and fees may apply, so read terms carefully.

Carrying any balance after a transfer can eliminate the grace period on new purchases, causing interest to accrue on those purchases immediately unless the entire statement balance, including the promotional balance, is paid by the due date.

A debt consolidation loan can convert revolving debt into a fixed-rate installment with a defined payoff date, improving predictability and protecting against credit card penalty structures and shifting APRs. Treat consolidation as a commitment to avoid new revolving balances; otherwise, total debt can rise despite lower rates.

Add Income And Reduce Bills To Accelerate Principal

Intro: Extra cash to Pay Off Debt Fast often comes from operational improvements rather than heroic sacrifice.

Small wins compound when automated and reviewed monthly. Keep the list short, deploy methods quickly, and measure real dollars moved to principal.

- Negotiate recurring bills such as mobile, internet, insurance, and subscriptions; switch providers when retention offers fall short.

- Convert idle items into cash via local marketplaces or consignment, and earmark every sale for the next extra payment.

- Launch a targeted side gig aligned to skills—virtual assistance, tutoring, pet care, delivery—then batch payouts into weekly principal hits.

- Ask for a raise using market data and specific impact examples, and divert the incremental net pay to your highest-priority account.

- Direct tax refunds, bonuses, or windfalls to lump-sum principal reductions to meaningfully shorten payoff timelines.

Protect Credit While Paying Down Balances

Maintain on-time payments across all accounts; payment history remains the largest scoring factor. Lowering the credit utilization ratio, your revolving balances divided by total limits, can support score improvements over time; there’s no single “ideal” percentage, but lower is generally better from a risk perspective.

Closing a card can raise utilization by shrinking available credit, so evaluate effects before reducing open lines.

Avoid cash advances on credit cards because fees and immediate interest accrual make them expensive relative to alternatives.

Keep Accountability And Motivation High

Progress sticks when someone reliable checks in on commitments. Ask a trusted friend or family member to serve as an accountability partner, agree on weekly micro-goals, and celebrate each closed account.

Tracking balances monthly in a simple spreadsheet reinforces momentum, especially when the first card or loan drops to zero.

FAQs: Fast Clarifications That Prevent Costly Mistakes

Intro: Short answers here address the questions that most often slow progress. Apply them immediately and return attention to your chosen method.

- Is it smart to pay more than the minimum? Yes—extra dollars go to principal, reduce interest paid, and shorten payoff time; minimums alone prolong repayment dramatically.

- Which card should get the extra payment? For math efficiency, target the highest APR (avalanche). For motivation, target the smallest balance (snowball). The CFPB highlights both approaches as valid.

- Should closed cards stay closed after payoff? Consider utilization impact before closing; fewer open lines can raise utilization and pressure scores.

- Are balance transfers always a good deal? No; fees, promo expirations, and loss of grace period on new purchases can erase savings if terms aren’t managed tightly.

- What protects consumers from abusive collections (U.S.)? The FTC enforces the Fair Debt Collection Practices Act, which restricts harassing practices and provides complaint avenues.

Practical Momentum Builders

Quotes can help anchor habits. “The key is finding a method you can stick with,” noted Dan Nickele, vice president of Discover® Personal Loans.

Regular reviews keep payments aligned to goals, and a single extra principal hit each payday compounds more than most people expect.

Keep spending controls tight during promotions or consolidation to ensure balances only move down.

Conclusion

Clear visibility, a realistic budget, and one chosen method create the conditions to Pay Off Debt Fast. Automate minimums everywhere, funnel every spare dollar to a single target, and protect credit health while interest falls.

If debt becomes unmanageable, escalate promptly to nonprofit counseling, evaluate consolidation carefully, and reserve settlement or bankruptcy for regulated, well-advised scenarios. Consistency wins; a stable plan beats sporadic intensity every time.