If you have ever wondered how to track all your accounts in one app, this guide walks you through the why, the how, and the trusted tools that make it simple.

You will learn the benefits of consolidating checking, savings, cards, loans, investments, and even rewards into one secure dashboard.

The article also explains the features to prioritize so your data stays accurate, private, and always in sync. By the end, you will know which apps to try first and how to set up a clean workflow that saves hours every month.

Why You Need to Track All of Your Accounts in One App

Bringing every balance and transaction into a single view eliminates guesswork and surfaces your true cash flow in seconds.

When you can see banking, credit, and investments together, decisions about spending, saving, and debt payoff become easier to make.

A unified dashboard also highlights duplicate subscriptions, unused services, and hidden fees you can cut right away.

Over time, fewer surprises and faster reviews mean less stress and more momentum toward your goals.

Clarity, Control, and Real-Time Cash Awareness

A modern aggregator shows posted and pending activity across accounts so you always know what is safe to spend. That clarity prevents accidental overdrafts and makes it easier to align money with priorities like emergency funds or travel.

Net worth and category trends reveal the story of your finances without spreadsheets or manual updates. With the right settings, you can export data whenever you want a deeper dive in your own files.

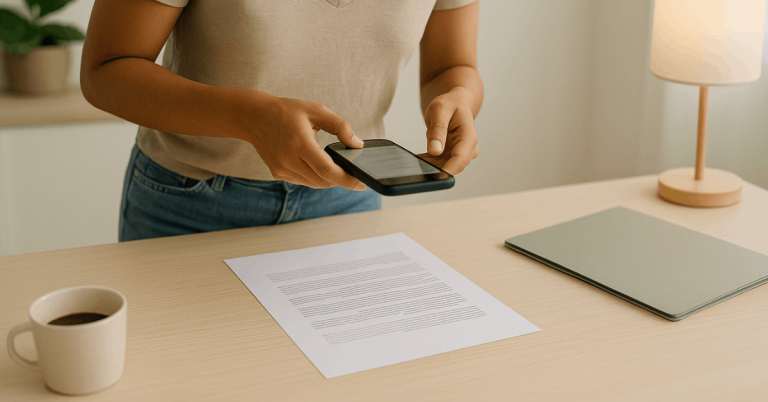

Time Savings from Automated Feeds and Categorization

Secure connections pull balances and transactions automatically, replacing hours of manual entry each week. Many apps auto-categorize spending and learn from your edits so reports get sharper over time.

Bank-grade feeds also reduce typos and missing purchases that break budgeting and forecasting. With the mechanics handled, you can focus on planning instead of bookkeeping.

Better Alerts, Fewer Fees, and Proactive Security

Account-level alerts notify you about large charges, low balances, or unusual activity before problems grow. Some apps check connection health and prompt you when a bank changes its login or security flow.

Consolidation also makes it easier to spot card duplicates and recurring charges you meant to cancel. Smart notifications and quick reviews together cut late fees, interest, and avoidable hassles.

What to Consider When Choosing an “All Accounts” App

Picking the best app is about safe data access, reliable coverage, and features you will use every week.

Start with the connection method and the provider behind it because that determines stability and privacy.

Then weigh the reporting, collaboration, and export options that fit your personal or household workflow. Finally, confirm pricing and long-term support so you are not rebuilding later.

Data Access, Open Banking, and Connection Tech

Look for connections powered by secure APIs and OAuth rather than legacy credential sharing wherever possible.

Open banking frameworks allow you to authorize access and revoke it easily while reducing reliance on brittle screen scraping.

Reputable providers explain whether they use aggregators like Plaid or multiple networks to improve reliability and coverage. Understanding this layer helps you choose a tool that stays connected without constant re-linking.

Coverage, Performance, and Feature Depth

Confirm the app supports your primary bank, cards, brokerage, loans, and even employer retirement plans before committing. Strong products publish what they track, from cash and credit to investments, net worth, and cash-flow projections.

Fast syncing, stable connections, and good categorization reduce maintenance and make weekly reviews simple. A clear feature page or support hub is a good sign the vendor delivers on its promises.

Privacy Controls, Pricing, and Export Options

Choose apps that explain data handling plainly, including encryption, MFA, and the ability to delete or export your data. If the tool offers a free tier, compare it to paid plans and consider whether time savings justify a subscription.

Some providers monetize via ads or offers, so decide if that tradeoff fits your expectations of privacy. Easy CSV or spreadsheet export ensures you can analyze history or switch tools without losing work.

The Best Apps to Track All of Your Accounts in One Place

The apps below come from established brands or highly regarded upstarts with clear documentation and active development.

Each offers secure aggregation plus planning tools that reduce friction in daily money management.

Coverage differs by country and institution, so confirm your specific banks and brokerages during a free trial. With that caveat, these are strong starting points that work well for many households.

Empower Personal Dashboard for Free Net Worth and Investments

Empower Personal Dashboard, formerly Personal Capital, provides free aggregation with net worth tracking, cash-flow views, and investment analytics.

The company clearly states it offers financial account aggregation and outlines security features and MFA options in its support resources.

Investors appreciate holdings breakdowns and fee analyses that go beyond basic budgeting. If you want a robust free overview with strong portfolio visibility, this dashboard is a compelling option.

Monarch Money for Flexible Budgeting and Multi-Aggregator Connectivity

Monarch Money focuses on clarity and collaboration, bringing all accounts into one customizable home base. The team highlights multiple aggregator options and even lets you choose a preferred network for a given institution.

That flexibility can improve reliability when one data provider has temporary issues with your bank. Couples also like shared views and planning tools that make budget check-ins straightforward.

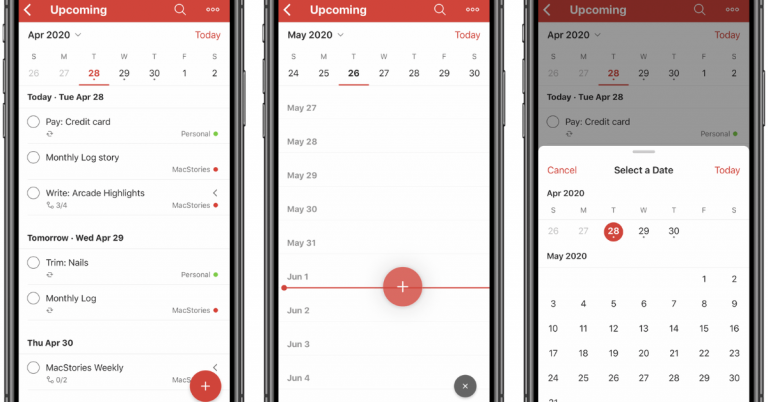

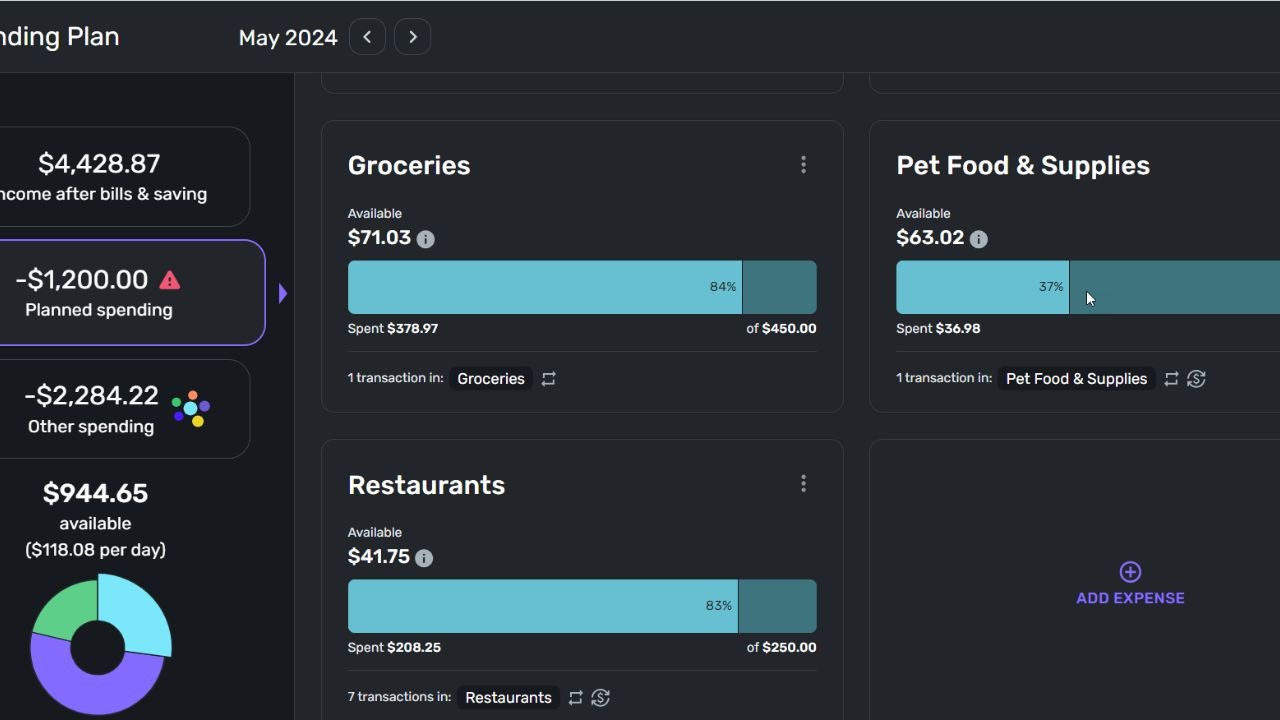

Quicken Simplifi for Cash-Flow Planning and Forecasting

Quicken Simplifi is designed to show all your finances in one place with projected balances and spending plans.

Official materials emphasize categorized reports, cash-flow projections, and goal tracking for a practical, week-to-week view.

The app comes from a long-standing brand and is updated frequently with usability improvements. If you want a modern Quicken-style experience without desktop software, Simplifi is a strong fit.

YNAB for Zero-Based Budgeting with Bank Connections

YNAB centers on giving every dollar a job while supporting linked accounts for fast importing. The company’s support documentation explains how to manage bank connections and keep data in sync across devices.

Users who favor hands-on budgeting like YNAB’s rules and intentional planning approach. Paired with links to your banks, it becomes a tight loop from transaction to category to decision.

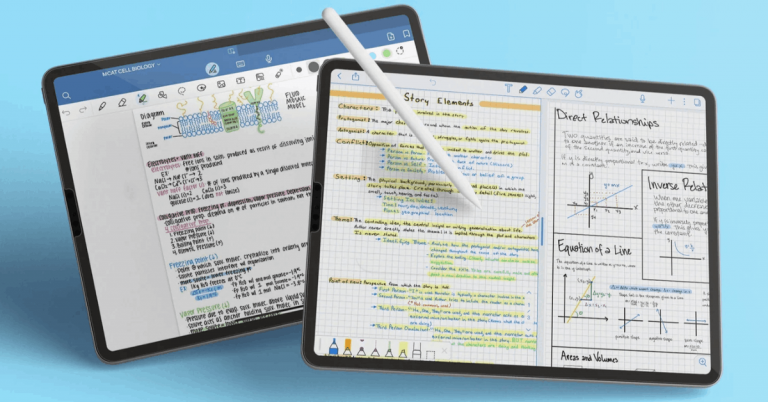

Tiller for Spreadsheet Lovers Who Want Automated Feeds

Tiller connects your banks to Google Sheets or Microsoft Excel and updates balances and transactions daily.

The company details its security posture and privacy model, including encryption and a subscription-supported business without ads.

For people who love custom categories and formulas, automated feeds into a spreadsheet offer power and transparency. Templates for budgets and net worth make setup faster while leaving room for full control.

Fidelity Full View for Customers Who Want a Free Aggregator

Fidelity’s Full View is an account aggregation service for customers, operated by affiliate eMoney Advisor. The firm notes that the service is provided at no additional charge with its own terms and limits separate from the core brokerage site.

It is useful if you already use Fidelity and want a consolidated net worth and account list inside your existing login. Availability is for customers, so you may need an account before exploring the tool.

The Post-Mint Landscape and What It Means for You

Intuit discontinued Mint and encouraged users to move to Credit Karma, which lacks robust budgeting and aggregation depth.

Independent reviews point out that Mint’s features were not fully replicated, pushing many users to the apps listed above.

This shift accelerated innovation across competitors focused on reliability, planning, and clean design. If you are migrating from Mint, test imports and features carefully to ensure a smooth transition.

Conclusion

You now understand how to track all your accounts in one app and which features separate a smooth experience from daily frustration. Start with secure connections, confirm coverage for your banks and brokerages, and enable MFA and alerts from day one.

With a ten-minute weekly review and a reliable dashboard, you will spend less time managing money and more time making it work for what matters most.