If you want a stress-free way to take control of your money, start by mastering how to build a monthly budget using simple tools that you already have.

This guide shows why a budget matters, what to consider before you begin, and which apps or templates can make the process painless. You will learn a step-by-step workflow you can follow in less than an hour each week.

By the end, you will have a realistic plan that protects essentials, reduces waste, and grows savings month after month.

Why Learning to Budget Changes Everything

A monthly budget turns vague intentions into a clear, repeatable plan you can execute.

It replaces guesswork with numbers, so you always know what you can spend without guilt.

The practice builds confidence because you decide your priorities before the month starts. Over time, those small choices compound into lower stress and better financial outcomes.

Clarity and Control Over Every Dollar

When you map income and expenses, you see exactly where your money goes and why. That visibility lets you align spending with goals like debt payoff, travel, or an emergency fund.

You begin to trade impulse buying for deliberate decisions that serve your future self. Control replaces anxiety the moment your plan reflects real life.

Faster Debt Reduction and Stronger Savings

A written plan helps you direct extra cash to the balances that cost you most. As interest shrinks, momentum grows and frees more money for savings targets.

You can then automate transfers to build an emergency fund that protects your progress. The feedback loop is simple and powerful, which keeps motivation high.

Better Decisions and Lower Money Stress

Budgets reduce decision fatigue because you no longer renegotiate every purchase. You know which categories are flexible and which must stay fixed to keep bills current.

That clarity eases family conversations and prevents end-of-month surprises. Peace of mind becomes the most valuable return on your planning time.

What to Consider Before You Build Your Monthly Budget

Good budgets start with accurate inputs and realistic expectations. You need a clear picture of income, obligations, and habits that may need small adjustments.

A few thoughtful choices now will prevent frustration later. The following pillars will help you set the right foundation.

Define Goals and Time Horizons Up Front

Decide what success looks like this quarter and this year so your plan has direction. Short-term goals could include paying off a card or funding a weekend trip.

Longer-term targets might involve a home down payment or professional training. Clear priorities guide tradeoffs when money tries to flow elsewhere.

Understand Income Types and Pay Schedules

List base pay, side income, and benefits so you are not planning with guesses. If your pay fluctuates, budget around a conservative average to avoid shortfalls.

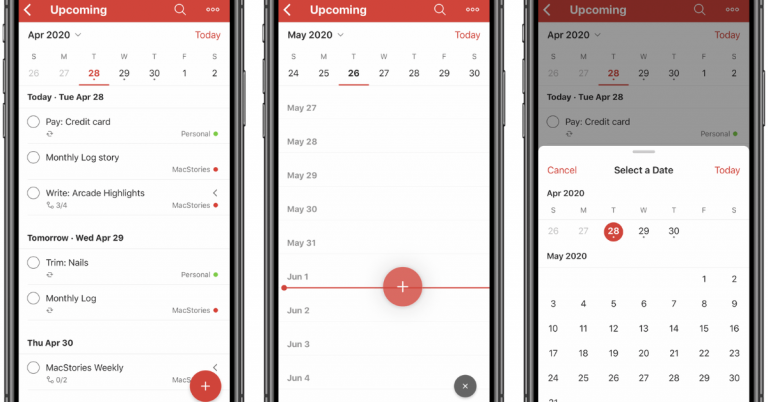

Align due dates with paycheck timing to minimize cash crunches. A simple calendar view helps you see when to schedule payments safely.

Separate Fixed, Variable, and Non-Monthly Costs

Fixed costs are the bills that rarely change, such as rent, utilities, and insurance. Variable costs include groceries, fuel, dining, and personal spending that you can influence.

Non-monthly costs like car tags or annual subscriptions need sinking funds. When each type has a place, the rest of your plan stays balanced.

Simple Tools and Apps That Make Budgeting Easy

You do not need complex software to build a great budget. Spreadsheets, banking apps, and dedicated budgeting tools can work separately or together.

Choose the mix that matches your habits and tech comfort. Reliability and clarity matter more than fancy features.

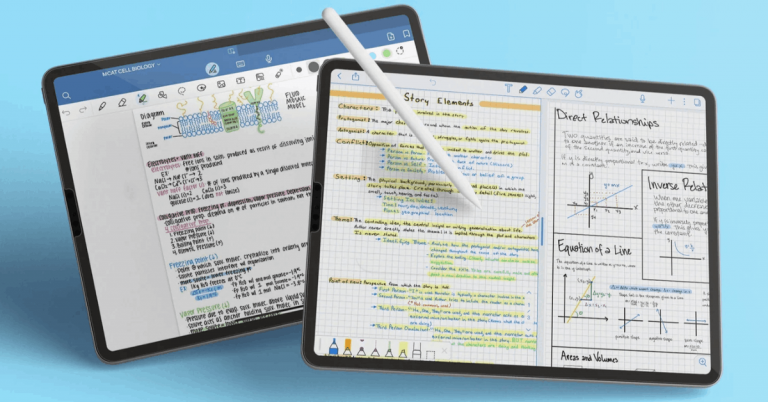

Spreadsheet Templates for Full Control and Transparency

Google Sheets and Microsoft Excel offer free monthly budget templates with categories, charts, and summaries. You can customize columns, add notes, and lock formulas to prevent mistakes.

Sharing access lets partners review numbers without juggling multiple files. Spreadsheets remain the most flexible option when you want complete visibility.

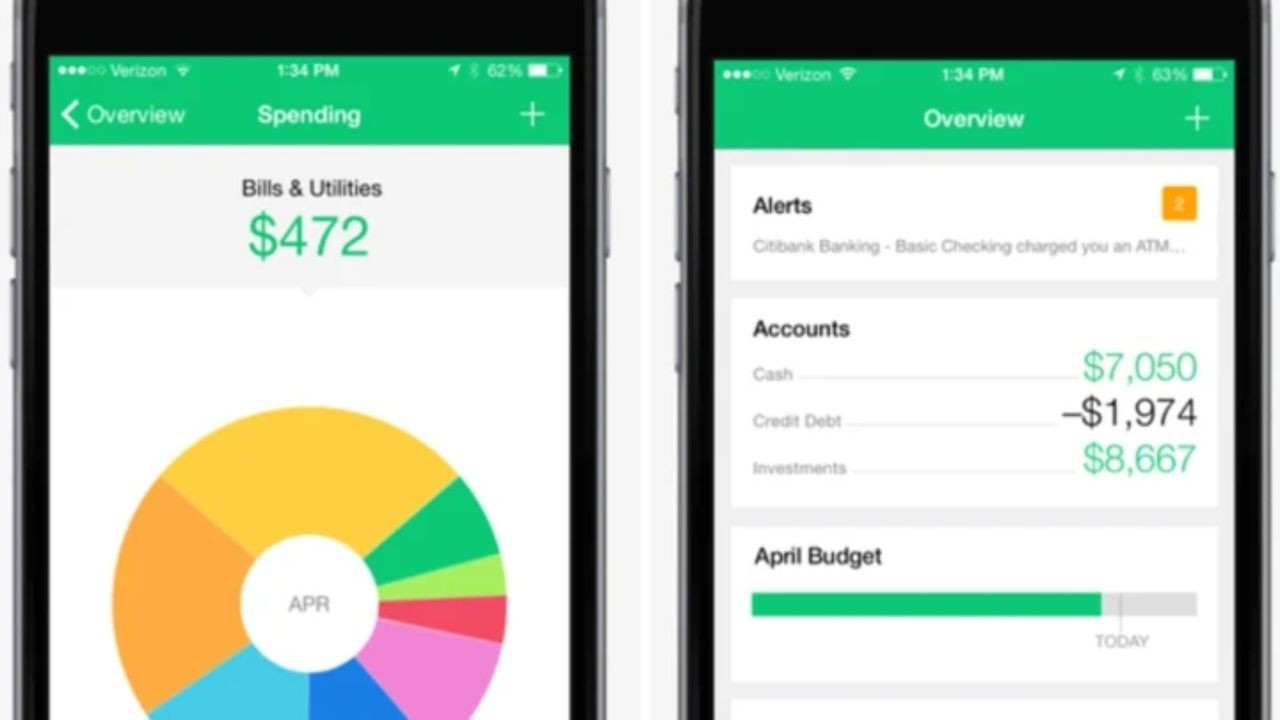

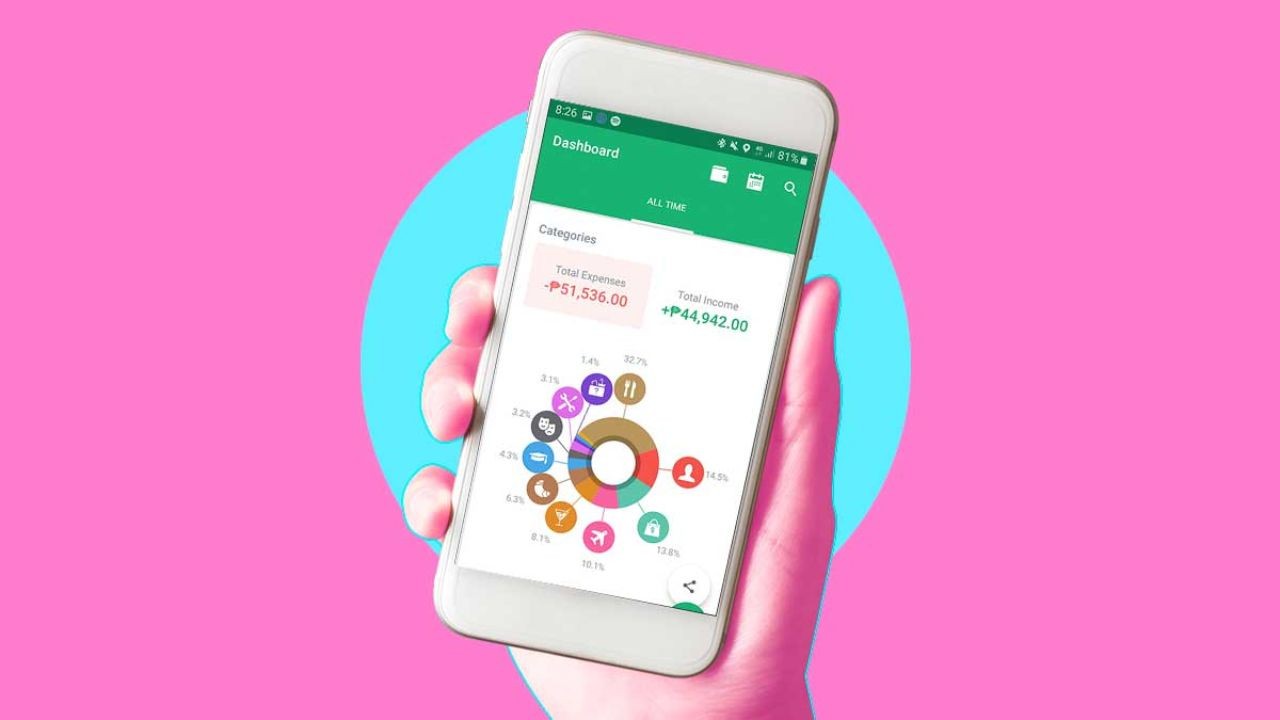

Banking and Card Apps for Real-Time Transactions

Modern banking apps categorize spending and show trends that reveal habits quickly. You can set alerts for large purchases, low balances, or upcoming due dates.

Many apps let you create saving “buckets” or “vaults” for goals and sinking funds. Real-time data makes it easier to reconcile your plan with reality.

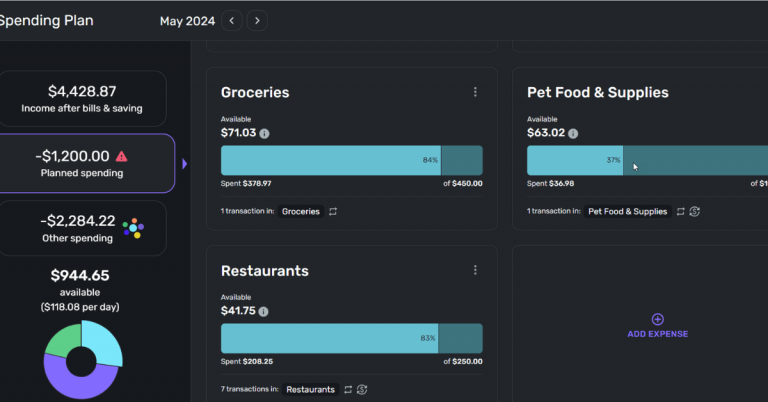

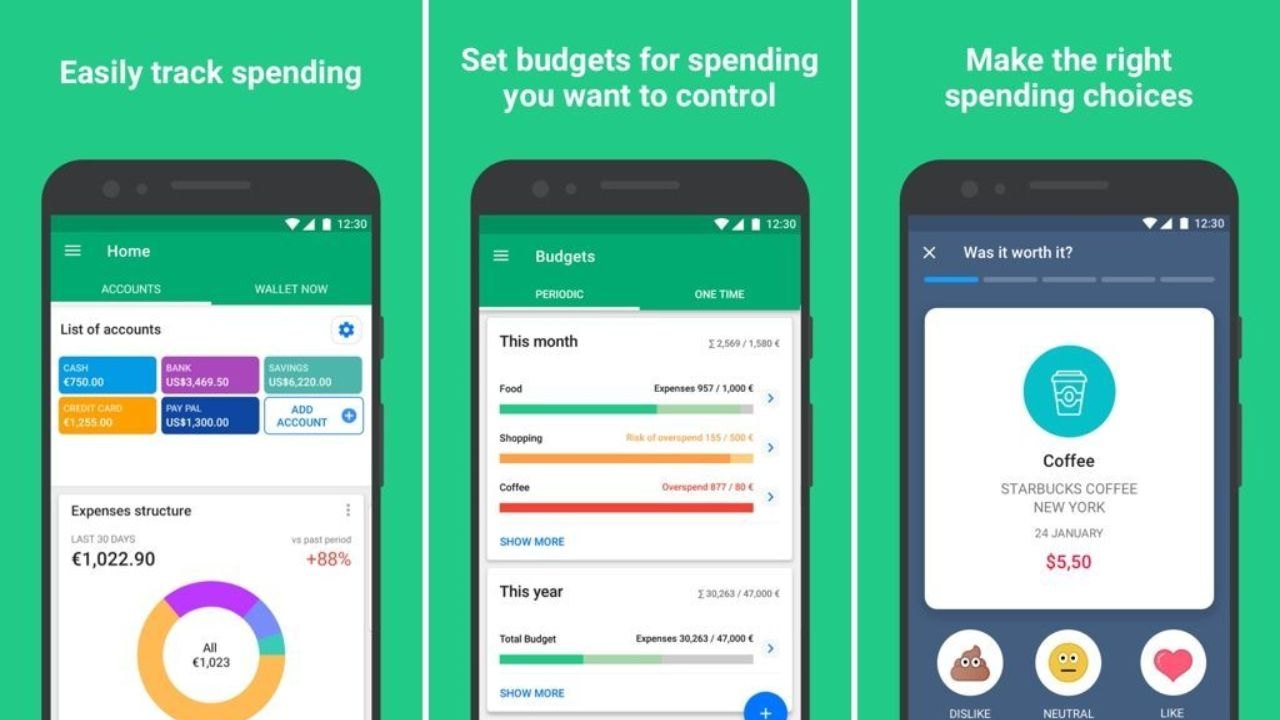

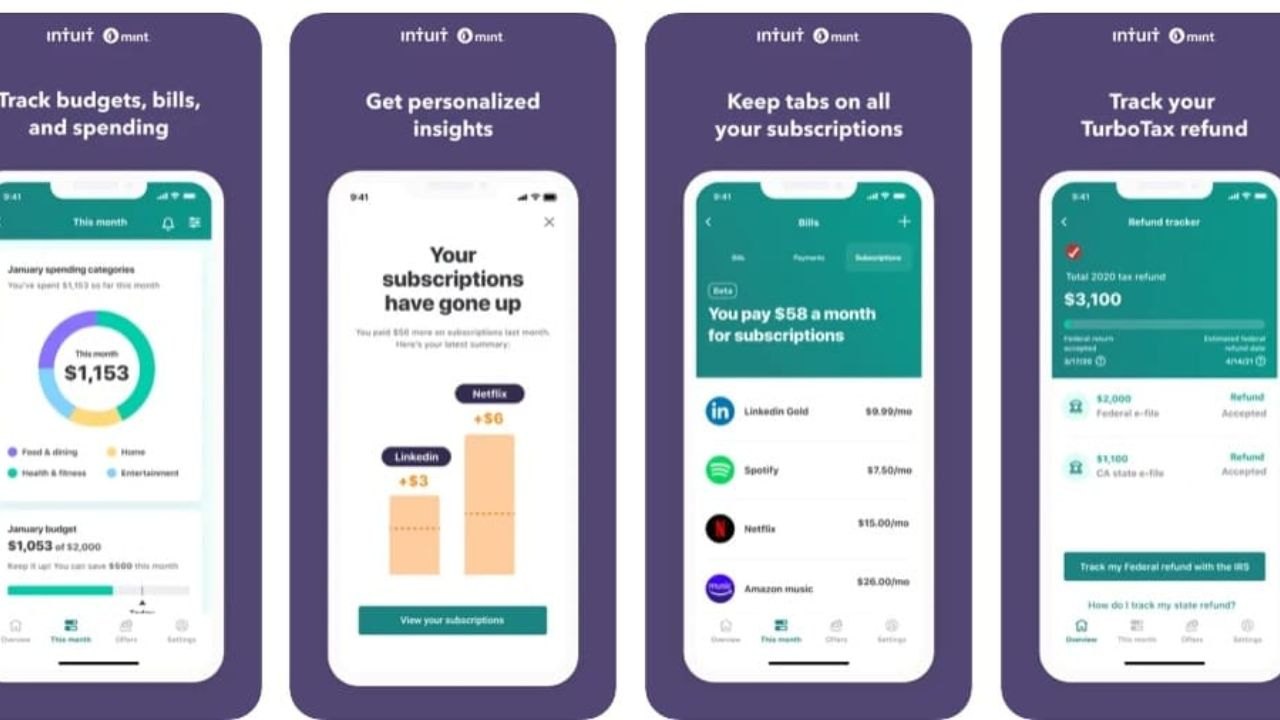

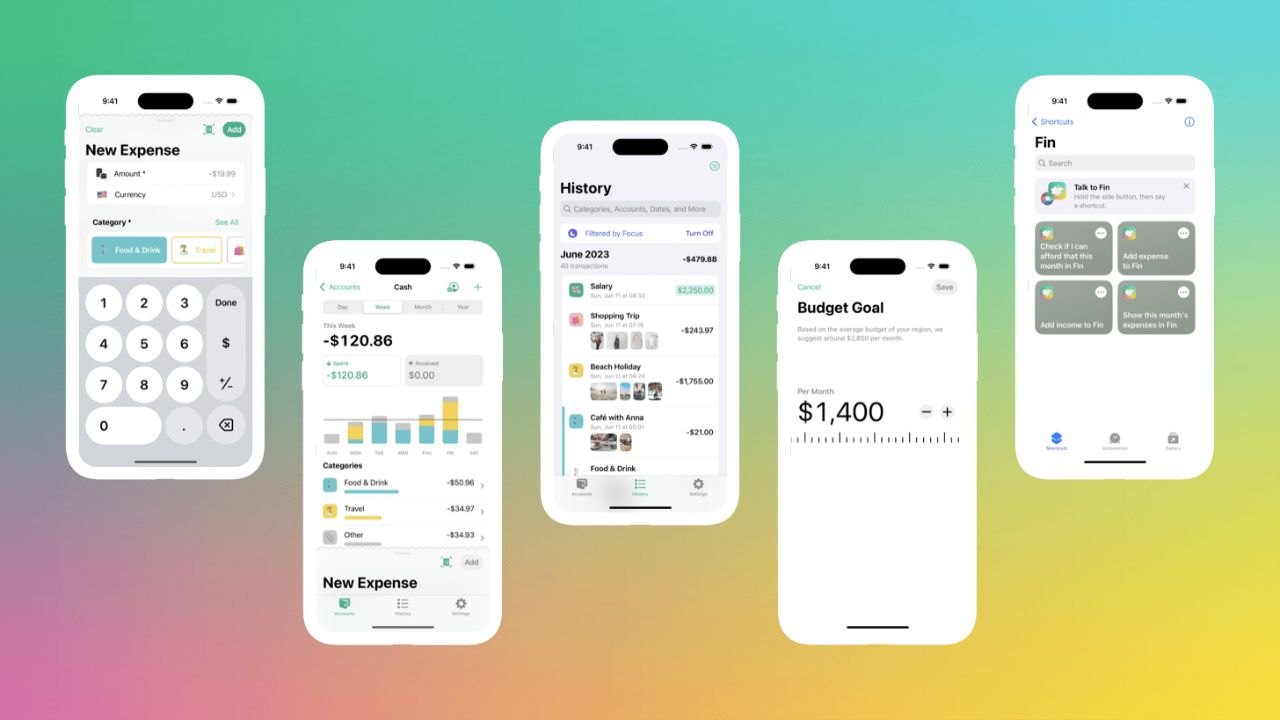

Dedicated Budgeting Apps for Structured Workflows

You can use apps that follow zero-based or envelope methods to give every dollar a job. These tools excel at category rules, rollovers, and helpful reports that track progress.

Some apps integrate with banks for quick imports, while others prefer manual entry for control. Pick the workflow that keeps you most consistent week to week.

Step-by-Step: How to Build a Monthly Budget Using Simple Tools

A repeatable workflow beats a complicated system every time. The steps below work whether you prefer a spreadsheet, a bank app, or a dedicated tool.

Plan to revisit each step weekly for ten minutes. That small rhythm keeps your numbers honest and your stress low.

Gather Statements and Set a Real Baseline

Pull the last two or three months of statements for income and expenses. Average irregular categories like fuel or groceries to create a sensible starting point.

List minimum debt payments so you never fall behind while you optimize. Your first budget should mirror real life, not wishful thinking.

Assign Categories and Give Every Dollar a Job

Start with essentials, then fund goals and discretionary items in order of importance. Name categories clearly so you know exactly what counts and what does not.

Add a small buffer for surprises while you learn your true spending rhythm. When every dollar has a destination, overspending becomes easier to spot.

Review Weekly and Reconcile Against Reality

Compare planned categories with actual transactions and adjust forward, not backward. Move small amounts between flexible categories when life changes mid-month.

Note one lesson each week to refine estimates and avoid repeat mistakes. Repetition turns budgeting into a quick habit instead of a chore.

Common Budgeting Mistakes and How to Avoid Them

Most failures come from over-optimism, missing data, or neglecting reconciliation. You can sidestep those traps with modest expectations and consistent check-ins.

Think of your budget as a living document that learns with you. The aim is progress, not perfection.

Setting Categories That Are Too Tight

If you squeeze groceries or fuel below realistic levels, you will bust categories quickly. Start with the higher end of your average and trim gradually as habits improve.

Celebrate small wins and keep adjustments incremental. Sustainable change outperforms heroic short-term cuts.

Ignoring Cash Purchases and Small Fees

Untracked cash and overlooked fees can quietly wreck a good plan. Enter cash spends quickly or take photos of receipts to log later.

Review account activity for subscriptions or charges you no longer use. Closing leaks is the fastest way to free money for goals.

Skipping Reconciliation and Hoping for the Best

If you never compare plan versus actuals, your budget turns into a wish list. Weekly reconciliation takes minutes and prevents end-of-month shocks.

Treat the review like brushing your teeth, small and non-negotiable. The habit keeps your numbers honest and your confidence high.

How to Keep Improving Your Budget Every Month

Budgets get easier and more accurate as you collect data. Treat each month like a small experiment and keep what works.

You will notice patterns that suggest smarter category sizes and better timing. Iteration turns a good plan into an effortless routine.

Run a Monthly Retrospective and Capture One Insight

Review category totals and note the single change that would help most next month. That might be a higher grocery target or a smaller entertainment line.

Implement only one tweak so you can isolate the effect. Small, steady improvements beat large swings.

Tie Spending to Values and Seasonal Reality

Real life has holidays, travel, and school cycles that affect costs. Build seasonal templates that anticipate those spikes without panic.

Align discretionary spending with what you actually enjoy, not trends. Budgets feel generous when categories reflect your real priorities.

Celebrate Wins and Reinvest the Savings

Track milestones like the first month with no overdraft or a fully funded emergency buffer. Move the savings to a goal that excites you so motivation stays high.

A visible win keeps everyone engaged in the process. Positive momentum becomes your best financial habit.

Conclusion

You now know how to build a monthly budget using simple tools that fit your lifestyle and attention span. Start with clear goals, honest averages, and a tool you will actually open every week.

Combine automation, sinking funds, and quick reconciliations to keep the plan resilient when life gets busy. With steady reviews and small adjustments, your budget will protect essentials, accelerate goals, and deliver calm confidence all year long.