If you want to protect your money and credit score, learn the top mistakes to avoid when using credit cards before they cost you.

This guide explains how common missteps happen and what to do instead so every swipe supports your goals. You will see practical steps grounded in card rules, billing cycles, and scoring factors that lenders use.

By the end, you will know how to spot problems early and build a simple system that keeps fees and interest in check.

Top Mistakes to Avoid When Using Credit Cards: A Practical Guide

Avoiding common errors turns a complex product into a dependable daily tool. Many mistakes start small and then compound, so prevention is easier than repair later.

The examples below show what typically goes wrong and the fixes that stop losses quickly. Use these checkpoints in your monthly routine to keep your plan on track.

Paying Only the Minimum Balance and Growing Costly Interest

Minimum payments prevent delinquency but do little to eliminate debt in a reasonable timeframe. Interest compounds on the remaining balance and stretches repayment far longer than most people expect.

Commit to a fixed amount above the minimum or target the highest APR first for faster results. Even small increases can shave months off and meaningfully lower total interest.

Late Credit Card Payments and the Penalty APR Trap

A single late payment can trigger late fees, penalty APRs, and credit score damage when it hits thirty days. Some issuers also revoke promotional rates after a late event, which raises costs overnight.

Set automatic payments for at least the statement minimum to avoid accidental misses. Pair auto-pay with alerts so you still review statements and catch errors.

Maxing Out Credit Limits and Hurting Utilization Ratios

Running balances near the limit compresses utilization and can reflect poorly even with on-time payments. High ratios can also reduce your available buffer if an emergency hits mid-cycle.

Spread purchases across cards or make mid-cycle payments to keep ratios healthier. Treat the limit as a safety margin rather than a monthly target.

Overlooking Statement Errors and Credit Card Fraud Alerts

Small errors and duplicate charges are easy to miss when you skip monthly reviews. Issuers offer a dispute window, and quick action improves the chance of a clean resolution.

Turn on real-time alerts so unusual charges surface immediately on your phone. A five-minute check each month prevents slow leaks and bigger headaches later.

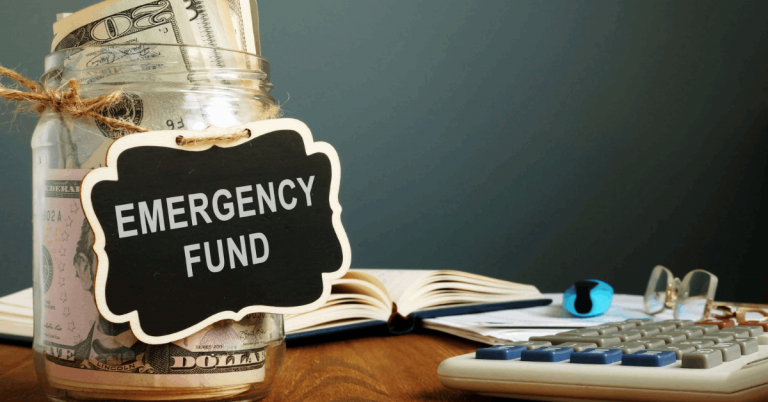

Credit Card Cash Advances and Why They Are So Expensive

Cash advances usually carry higher APRs, transaction fees, and no grace period at all. Interest often accrues daily until the entire amount is repaid in full.

If you must use one, repay it quickly and avoid repeated withdrawals. Planning an emergency buffer helps you skip this costly feature entirely.

Chasing Credit Card Rewards While Carrying a Balance

Rewards rarely offset double-digit interest, so points can become very expensive. Focus on eliminating interest first so your redemptions are truly free value.

Once interest is gone, align one or two cards with real spending patterns. Rewards then support goals instead of masking costly borrowing.

Applying for Too Many Credit Cards in a Short Time

Multiple applications can create several hard inquiries and shorten average account age. Opening many lines at once may look risky and complicate cash-flow planning.

Space applications and open new cards only for clear, usable benefits. A slower pace protects your profile while you learn each card’s features.

Closing Old Credit Card Accounts and Shortening Credit History

Your oldest accounts anchor the length of your credit history and support utilization buffers. Closing a long-standing card can shrink available credit and spike ratios quickly.

If the card has no annual fee, consider keeping it open with small periodic charges. When fees apply, explore retention offers or product changes before deciding to close.

Ignoring Annual Fees and Not Maximizing Card Benefits

Premium cards offer value only when you actually use the credits and protections. Holding a high-fee card without using benefits turns value negative fast.

Set reminders to use credits and reassess the card before the next fee posts. A downgrade can preserve history while aligning cost with real usage.

Misaligned Auto-Pay Dates That Disrupt Cash Flow

Full-balance auto-pay is great until timing collides with paycheck schedules. A mismatch can trigger overdrafts or force last-minute transfers that add stress.

Request due-date changes so payments land after income clears your account. If cash flow is tight, auto-pay the minimum and manually top up to avoid interest.

Balance Transfer Credit Cards Without Reading the Fine Print

Balance transfers can lower interest, but transfer fees and promo timelines matter. Missing a payment or failing to clear the balance before the promo ends can lead to a much higher APR.

Calculate the true cost and set an automatic payoff that ends before the promotion expires. Clear math upfront turns a teaser rate into real savings.

Mixing Personal and Business Credit Card Expenses

Combining expenses blurs categories and complicates taxes or profitability checks. It also hides your true personal spending patterns month to month.

Separate cards for personal and business use keep records clean and useful. Clean data simplifies audits and supports better decisions all year.

Authorized User Risks Without Spending Controls

Adding an authorized user can help build credit history for someone else. It also expands risk because charges ultimately fall to the primary cardholder.

Agree on limits, enable alerts, and review activity together each month. If misuse occurs, remove the card promptly and reset expectations.

International Travel Fees and Credit Card Trip Preparation

Some cards add foreign transaction fees that inflate costs on international purchases. Failing to set travel plans can also trigger inconvenient fraud holds.

Choose a card without foreign fees and confirm chip, tap, or PIN compatibility. Preparing ahead prevents declines, delays, and unnecessary charges while abroad.

Skipping Built-In Credit Card Protections and Warranties

Many cards include purchase protection, extended warranty, rental coverage, and dispute support. Ignoring the benefit guide means you might pay for coverage you already have.

Filing claims on time with proper receipts can save hundreds on damaged items. Learning benefits once produces value for years with little effort.

Sharing Card Numbers Insecurely and Increasing Fraud Risk

Sending full card details by text or email raises the chance of theft. Use secure checkout portals, virtual card numbers, or tokenized mobile wallets when possible.

Turn on two-factor authentication and transaction alerts to catch issues quickly. Fewer exposure points make everyday spending safer.

Not Freezing Unused Credit Cards to Reduce Exposure

Dormant cards with exposed numbers can be easy targets if databases are breached. Many issuers let you lock or freeze a card instantly without closing it.

Keeping unused cards locked reduces risk while preserving account age and limit. Periodic checks ensure only necessary cards remain unlocked.

Paying Avoidable Credit Card Fees Without Negotiating

Late or returned payment fees may be negotiable when you have a good history. A courteous call can sometimes secure a one-time waiver or a retention credit.

You can also request a product change to a no-fee version that fits better. Asking costs nothing and can save meaningful cash each year.

Ignoring Credit Reports and Score Monitoring Best Practices

Errors and identity theft signs can linger when you never review reports. Checking your files helps you spot unknown accounts, wrong balances, or odd inquiries.

Many issuers provide free scores and alerts that supplement official reports. A quarterly review habit keeps your profile accurate and resilient.

Using Credit Cards to Mask Budget Problems Long Term

Cards can smooth timing, but they cannot fix chronic overspending. Rolling balances forward hides issues until interest and fees make them obvious.

A basic monthly budget and small emergency fund reduce pressure to borrow. Sustainable habits turn credit from a crutch into a useful tool.

Credit Card Best Practices: Habits That Replace Expensive Errors

Replacing pitfalls with smart routines is how you turn convenience into long-term value. The goal is to automate protection while keeping visibility high and stress low.

A few guardrails prevent most mistakes before they start to grow. Use this framework to keep interest down and scores steady through busy seasons.

Automate Credit Card Payments and Review Statements Monthly

Enable auto-pay for at least the statement minimum to avoid accidental late marks. Add calendar reminders for both closing and due dates so timing never surprises you.

Turn on purchase alerts and review statements to confirm credits and charges. These small habits form a protective layer that runs quietly in the background.

Mid-Cycle Payments to Lower Credit Utilization Before Reporting

If your balances are high on statement day, pay once mid-cycle and again before the close. Lower reported utilization can support scores even when total spending stays the same.

Track large categories so high-spend months do not catch you off guard. A predictable cadence stabilizes both cash flow and reported ratios.

Make Credit Card Rewards Profitable by Eliminating Interest First

Interest erases the value of most points and cash back very quickly. Pay off high-APR balances before optimizing categories or bonuses.

Then match one or two cards to real spending and redeem on a schedule. With interest at zero, rewards finally become pure upside.

Conclusion

You now understand the top mistakes to avoid when using credit cards and the habits that keep costs down. Prioritize on-time payments, manage utilization, and read fine print before using balance transfers or cash advances.

Review statements and reports regularly, automate guardrails, and treat rewards as a bonus after interest is gone. With these practices, your cards become efficient tools for convenience, protection, and long-term financial health.