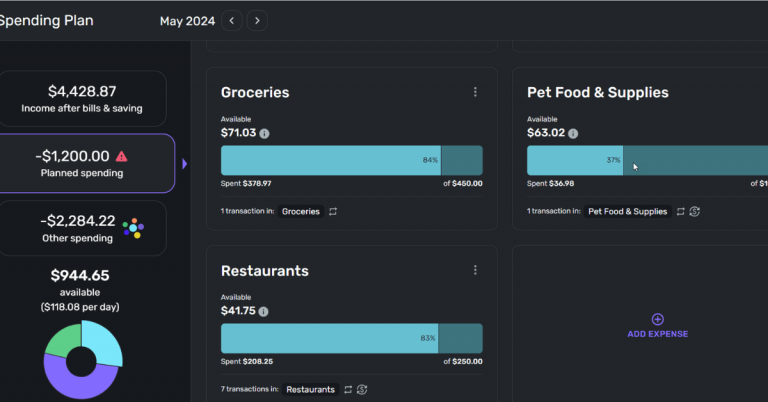

Digital envelopes replicate the classic “cash-in-envelopes” method inside your bank or budgeting app.

You assign money to categories before you spend. You track in real time and adjust quickly.

The goal is to make every dollar work for a job and stay within limits. The envelope method is a straightforward way to budget.

What “Digital Envelopes” Mean

Digital envelopes are labeled buckets or sub-accounts that separate money for specific purposes: rent, groceries, transit, debt, or savings goals.

You move funds into each envelope at the start of the month or when you get paid.

You then spend only from the matching envelope. This mirrors the cash system, but done in your bank or app.

Why this method works

You see your true discretionary balance because fixed bills and priorities sit in their own envelopes.

You prevent overspending in one area because money is fenced off. You align well with zero-based budgeting, where income minus all planned uses equals zero.

In practice, you give every dollar a job across needs, savings, and debt.

Where to Create Envelopes (common options)

You can do digital envelopes inside certain bank accounts that offer built-in categories.

Ally Bank lets you create “Savings Buckets” within one savings account and set goals and target dates.

Monzo offers “Pots” to keep money separate from your main balance and automate bills.

Revolut uses “Vaults” and “Pockets” to segment funds and set goals, including group saving. Check availability and terms in your region.

Step-by-Step: Set Up Your Digital Envelopes

Each step will guide you to your goal.

- List categories: Start with core fixed costs (rent, utilities, transport, minimum debt payments), then key variables (groceries, fuel), then savings goals and optional spending. Use a simple cash-flow worksheet to list uses ahead of time.

- Pick your tool: If your bank provides buckets or pots, use them. Otherwise, choose an app that supports category balances and rules. Confirm fees and data-sharing policies first.

- Create envelopes: In Ally, add “Savings Buckets” and define targets. In Monzo, create “Pots” for bills and spending. In Revolut, open “Vaults” or “Pockets,” set goals, and enable round-ups or automations if available.

- Fund on payday: Allocate income to each envelope immediately. With zero-based budgeting, assign 100% of income to envelopes, including a small “miscellaneous” buffer if you need it.

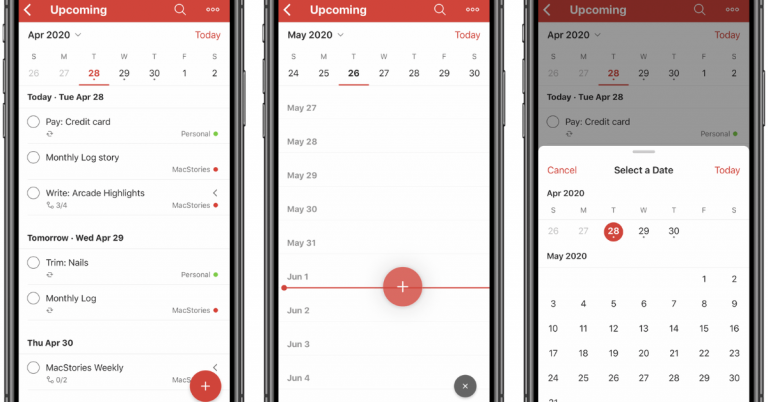

- Spend from the right place: Pay bills from the bills envelope/pot. Buy groceries from the grocery envelope. If an envelope empties, stop or move money intentionally from another envelope.

- Track and adjust weekly: Compare planned vs. actual. Move small amounts as needed. Update targets monthly using a cash-flow calendar.

- Automate: Use scheduled transfers into envelopes. Turn on boosters or round-ups where supported to grow savings in the background.

Practical Envelope Structure (example)

This layout forces visibility on needs first, then wants. It keeps your plan simple and enforceable.

- Essentials: Rent/mortgage; utilities; internet/phone; transport; insurance; minimum debt payments.

- Variables: Groceries, fuel, household, and personal care.

- Financial priorities: Emergency fund; sinking funds (car maintenance, medical, gifts); extra debt payments; retirement contributions (if applicable via bank transfer).

- Lifestyle: Eating out; entertainment; subscriptions; travel.

Budgeting apps (true envelope / envelope-style).

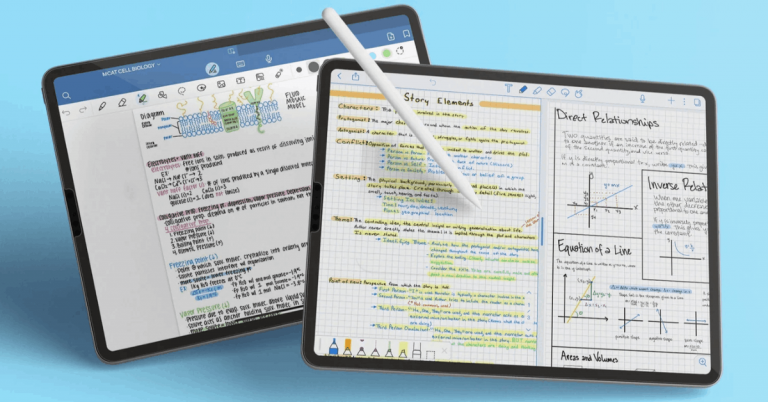

- YNAB (You Need a Budget): Zero-based method, category “envelopes,” rollovers, targets, and partner features (YNAB Together). Paid after trial.

- Goodbudget: Classic envelope budgeting with shared sync. Free tier; Plus unlocks more envelopes/devices. Manual entry focus.

- Qube Money: “Digital cash envelopes” with app-controlled spending from “Qubes.” Card-centric workflow. Check current availability.

- Monarch Money: Notches envelope-like control via category rollovers and custom categories/groups. Household collaboration.

Bank accounts with built-in “buckets/pots/spaces”.

- Ally: Create up to 30 buckets in one savings account; goals, dates, and automated contributions/boosters.

- SoFi— Vaults: Savings “vaults” act as buckets inside SoFi’s high-yield savings; organizes goals within one account.

- Monzo — Pots (incl. Bills Pots + Salary Sorter): Auto-sort pay into Pots and pay bills from a dedicated Pot. Strong automation for envelopes.

- Revolut — Pockets (formerly under Vaults): Segment money for bills/goals; personal and group Pockets; savings vaults have bank partners and FDIC coverage in the U.S. per issuer.

- N26 — Spaces (EU): Up to 10 sub-accounts with shared Spaces and option to spend directly from a Space.

- Starling Bank — Spaces (UK): Create Spaces and link virtual cards to spend from a specific Space. Supported in current account terms.

How to Handle Bills Automatically

Some banks let you pay bills directly from a dedicated bills pot or automatically move the needed amount before due dates.

“Bills Pots” and “Salary Sorter” models reduce errors and help you avoid overdrafts caused by mixed funds.

Confirm the exact steps and limits in your account.

Security and Privacy When Using Budgeting Apps

Before you connect an app to your accounts, review how data sharing works, what it collects, and how to revoke access.

Check the app’s security page for encryption, tokenized connections, and third-party data practices.

Use multi-factor authentication on your bank and budgeting app. Keep your device updated and use strong, unique passwords.

About Open Banking Connections

Many apps connect through aggregators and APIs instead of screen-scraping.

The industry is moving toward stronger standards for consumer-permissioned access and tokenized API connections.

This reduces risk compared with password sharing and gives you clearer permission controls. Prefer apps and banks that use direct.

Cost Control With Zero-Based Rules

Digital envelopes pair well with zero-based budgeting. You assign every dollar to a category, including savings and debt.

Your income minus planned uses equals zero. This rule prevents “leftover” cash from being spent without a plan.

Review allocations monthly and adjust based on actuals.

Troubleshooting Common Issues

Overspending early in the month. Split variable envelopes by week. Fund weekly amounts every Friday. Use calendar-based cash-flow tools to match timing.

Irregular bills. Create sinking-fund envelopes (car service, insurance, annual fees). Divide the annual total by 12 and fund monthly.

Mixed finances with a partner. Use joint or group envelopes where available and agree on amounts in advance. Shared vaults are one option.

Data-sharing discomfort. Use bank-native buckets and avoid connecting external apps. Review permissions often and revoke unused connections.

Final Notes

The envelope method is longstanding and simple to execute. Bank “buckets,” “pots,” and “vaults/pockets” are common features.

Open-banking standards affect how apps connect and how you control permissions.

Follow your bank’s documentation for the exact steps, and confirm availability where you live.