You want to save more without relying on willpower. Automation solves that.

You set rules once, and money moves to the right place on schedule.

Here’s how to build an automatic system that is simple, safe, and effective, using only verified practices.

Start With the Core Move: Automatic Transfers

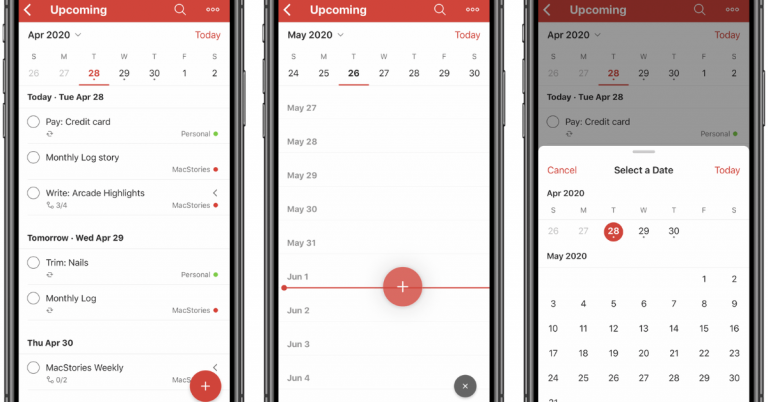

Your bank’s transfer feature can move a fixed amount from checking to savings on set dates.

Pick the schedule that matches your cash flow (payday is ideal).

Even small transfers add up over time. Set a target and test it for two pay cycles.

If you overdraw, lower the amount. If you finish the month with surplus cash, raise it. The key is consistency, not perfection.

Supercharge it with Split Direct Deposit

Ask payroll to split your paycheck. Send a percent or dollar amount straight to savings and the rest to checking.

This removes the chance you forget or second-guess.

To set it up, you provide routing and account numbers and choose amounts or percentages for each destination.

Most employers support multiple accounts. This method is “set and forget” and works even if you never log in to your bank.

Choose the Right Destination: a High-yield Savings Account

Automation works best when your money earns. High-yield savings accounts (HYSAs) at reputable banks or credit unions usually pay more than legacy accounts.

Rates change with market conditions, so confirm the current APY and any requirements before you move money.

Look for no monthly fees, easy transfers, same-day or next-day ACH, and clear disclosures. Verify FDIC or NCUA insurance.

The standard coverage is $250,000 per depositor, per insured bank, per ownership category.

Add “Round-Ups” and Rules-Based Automations

Beyond fixed transfers, you can automate small amounts based on triggers.

Common rules include rounding up purchases to the next dollar and moving the spare change to savings.

Some platforms invest round-ups once thresholds are reached. Review fees, terms, and transfer timing before enabling these features.

Also note the difference between saving (bank deposits) and investing (market risk). Choose what fits your goal.

Automate Your Emergency Fund First

Your first goal is a basic emergency fund. Start with a realistic target, like one month of essential expenses, then grow toward three to six months.

Use a recurring transfer on payday. Make the amount specific and repeatable. Increase it as your budget allows.

Keep this money in a liquid HYSA you can access quickly, not in volatile investments.

Revisit your transfer size each quarter and after any pay change. Keep the process simple so you stick with it.

Don’t Forget Retirement Automations

If you have a workplace plan, turn on automatic payroll contributions and consider auto-increase features that raise your contribution annually.

Aim to capture the full employer match. If you save to an IRA outside work, set a monthly transfer to reach the annual limit by year-end.

Check current IRS contribution limits, income-based deductibility (traditional IRA), and eligibility (Roth IRA).

Automations ensure progress even when you’re busy.

Protect Yourself

Use only FDIC- or NCUA-insured institutions for savings.

Confirm the bank or credit union is insured and keep your balances within coverage limits per depositor, per bank, per ownership category.

If you use third-party apps, review privacy policies, data-sharing practices, and the permissions you grant.

A Simple Setup Checklist You Can Follow Today

Stick with reputable providers, read terms, and monitor results.

- Pick your purpose and number: Define one goal at a time (for example, a $1,500 starter emergency fund). Decide the monthly amount and timeframe based on your cash flow. Write down your rule so it’s clear: “On each payday, transfer $X to savings.”

- Open or confirm your destination: Choose an insured HYSA with no monthly fees and easy transfers. Confirm APY, any minimums, and any caps on the rate. Make sure you can nickname sub-accounts or create “buckets” for different goals.

- Automate from day one: Set a recurring transfer on payday from checking to savings. Start modestly and adjust after you see two cycles. Prioritize consistency over size.

- Turn on split direct deposit: Send a percentage (for example, 5% to start) straight to savings. This keeps money out of checking by default and reduces spending temptation.

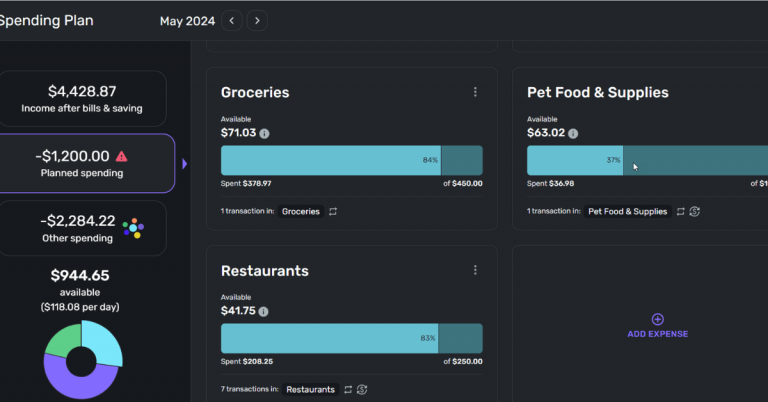

- Layer “rules”: Add round-ups or trigger-based rules if they fit your style. Keep fees low and know whether funds land in savings or investments. Set weekly or monthly summaries so you can review progress.

- Automate retirement: Enroll in your workplace plan, capture the match, and set an annual auto-increase. For IRAs, set a monthly transfer and track your progress toward the annual limit.

- Rebalance quarterly: Revisit transfer amounts, verify APYs, and confirm you remain within insurance coverage. Adjust contributions when income or expenses change. Move to a better account if your rate falls below peers.

Common Pitfalls to Avoid

Relying on promos. Avoid accounts that require complex hoops to earn the top tier unless you will reliably meet them.

Ignoring insurance limits. If you exceed them, open an account at another insured bank or use a different ownership category when appropriate.

Mixing goals in one account. Clear labels help you track progress and avoid accidental spending.

Letting automations run without review. Set calendar reminders or monthly alerts.

Best Tools to Use

Ally Bank – Savings Buckets & Recurring Transfers — Open an online savings account, set recurring transfers, and organize goals with “buckets.”

Capital One AutoSave (360 Performance Savings) — Create automatic transfers to savings on your preferred schedule in the mobile app.

Chime Automatic Savings — Turn on Round Ups and “Save When I Get Paid” to move money to savings automatically.

Qapital — Set rules (round-ups, payday, spending triggers) that automatically move cash toward named goals.

Bottom Line

Automating your savings is straightforward. Use automatic bank transfers and split direct deposit as your foundation.

Send funds to an insured HYSA, then layer simple rules to accelerate progress. Confirm rates, coverage, and app terms before you enable anything.

Review quarterly, increase contributions when you can, and keep your system simple. This approach helps you save more with less effort—day in, day out.